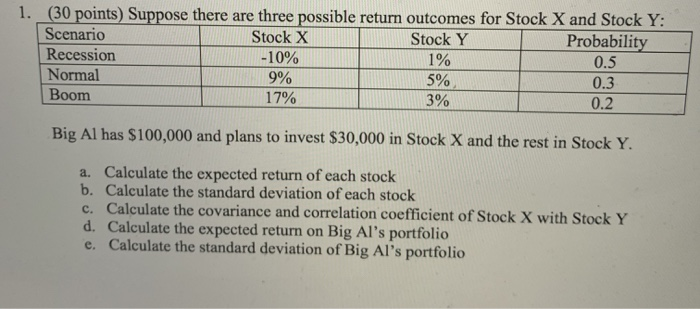

Question: 1. (30 points) Suppose there are three possible return outcomes for Stock X and Stock Y: Scenario Stock X Stock Y Probability Recession -10% 0.5

1. (30 points) Suppose there are three possible return outcomes for Stock X and Stock Y: Scenario Stock X Stock Y Probability Recession -10% 0.5 Normal 5% 0.3 Boom 17% 0.2 1% 9% 34 Big Al has $100,000 and plans to invest $30,000 in Stock X and the rest in Stock Y. a. Calculate the expected return of each stock b. Calculate the standard deviation of each stock c. Calculate the covariance and correlation coefficient of Stock X with Stock Y d. Calculate the expected return on Big Al's portfolio e. Calculate the standard deviation of Big Al's portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts