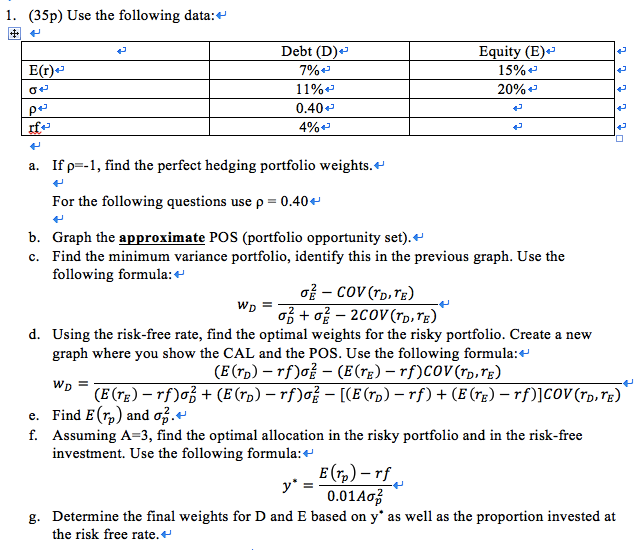

Question: 1. (35p) Use the following data:* Debt (D) Equity (E) 7%e 11%+' 0.40 15%+' 20% E(r) a. Ifp--1, find the perfect hedging portfolio weights.*- For

1. (35p) Use the following data:* Debt (D) Equity (E) 7%e 11%+' 0.40 15%+' 20% E(r) a. Ifp--1, find the perfect hedging portfolio weights.*- For the following questions use = 0.40- b. Graph the approximate POS (portfolio opportunity set).*- c. Find the minimum variance portfolio, identify this in the previous graph. Use the following formula:+ d. Using the risk-free rate, find the optimal weights for the risky portfolio. Create a new graph where you show the CAL and the POS. Use the following formula: Find E (Tp) and 4' Assuming A-3, find the optimal allocation in the risky portfolio and in the risk-free investment. Use the following formula:+ e. f. E(r)-rf y' =-0.01A Determine the final weights for D and E based on y' as well as the proportion invested at the risk free rate. g. 1. (35p) Use the following data:* Debt (D) Equity (E) 7%e 11%+' 0.40 15%+' 20% E(r) a. Ifp--1, find the perfect hedging portfolio weights.*- For the following questions use = 0.40- b. Graph the approximate POS (portfolio opportunity set).*- c. Find the minimum variance portfolio, identify this in the previous graph. Use the following formula:+ d. Using the risk-free rate, find the optimal weights for the risky portfolio. Create a new graph where you show the CAL and the POS. Use the following formula: Find E (Tp) and 4' Assuming A-3, find the optimal allocation in the risky portfolio and in the risk-free investment. Use the following formula:+ e. f. E(r)-rf y' =-0.01A Determine the final weights for D and E based on y' as well as the proportion invested at the risk free rate. g

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts