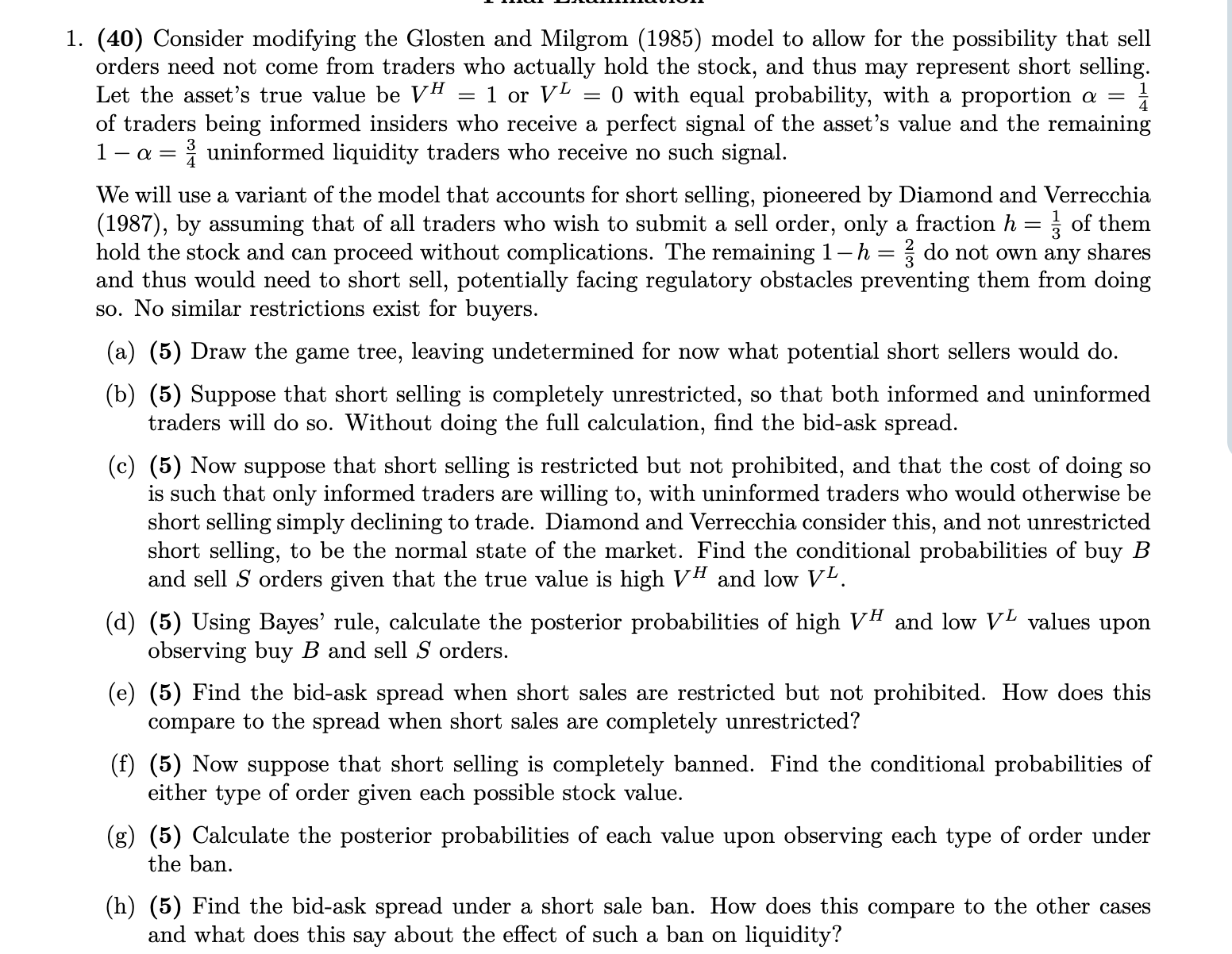

Question: 1 . ( 4 0 ) Consider modifying the Glosten and Milgrom ( 1 9 8 5 ) model to allow for the possibility that

Consider modifying the Glosten and Milgrom model to allow for the possibility that sell orders need not come from traders who actually hold the stock, and thus may represent short selling. Let the asset's true value be VH or VL with equal probability, with a proportion alphafrac of traders being informed insiders who receive a perfect signal of the asset's value and the remaining alphafrac uninformed liquidity traders who receive no such signal.

We will use a variant of the model that accounts for short selling, pioneered by Diamond and Verrecchia by assuming that of all traders who wish to submit a sell order, only a fraction hfrac of them hold the stock and can proceed without complications. The remaining hfrac do not own any shares and thus would need to short sell, potentially facing regulatory obstacles preventing them from doing so No similar restrictions exist for buyers.

a Draw the game tree, leaving undetermined for now what potential short sellers would do

b Suppose that short selling is completely unrestricted, so that both informed and uninformed traders will do so Without doing the full calculation, find the bidask spread.

c Now suppose that short selling is restricted but not prohibited, and that the cost of doing so is such that only informed traders are willing to with uninformed traders who would otherwise be short selling simply declining to trade. Diamond and Verrecchia consider this, and not unrestricted short selling, to be the normal state of the market. Find the conditional probabilities of buy B and sell S orders given that the true value is high VH and low VL

d Using Bayes' rule, calculate the posterior probabilities of high VH and low VL values upon observing buy B and sell S orders.

e Find the bidask spread when short sales are restricted but not prohibited. How does this compare to the spread when short sales are completely unrestricted?

f Now suppose that short selling is completely banned. Find the conditional probabilities of either type of order given each possible stock value.

g Calculate the posterior probabilities of each value upon observing each type of order under the ban.

h Find the bidask spread under a short sale ban. How does this compare to the other cases and what does this say about the effect of such a ban on liquidity?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock