Question: 1 : 4 4 : 2 0 remaining Page 2 2 of 2 6 Question 2 1 ( 4 points ) Listen If 1 0

:: remaining

Page of

Question points

Listen

If year Tbonds have a yield of year corporate bonds yield the maturity risk premium on all year bonds is and corporate bonds have a liquidity premium versus a zero liquidity premium for Tbonds, what is the default risk premium on the corporate bond?

of questions savedPrevious Page

Page of

Question points

Listen

You want to go to Europe years from now, and you can save $ per year, beginning one year from today. You plan to deposit the funds in a mutual fund that you think will return per year. Under these conditions, how much would you have just after you make the th deposit, years from now?

$

$

$

$

$

Page of

of questions savedPage of

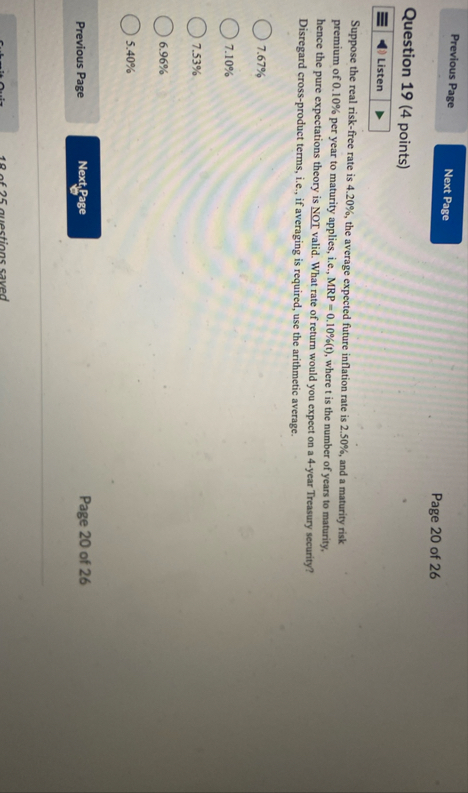

Question points

Suppose the real riskfree rate is the average expected future inflation rate is and a maturity risk premium of per year to maturity applies, ie where t is the number of years to maturity, hence the pure expectations theory is NOT valid. What rate of return would you expect on a year Treasury security? Disregard crossproduct terms, ie if averaging is required, use the arithmetic average.

Page of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock