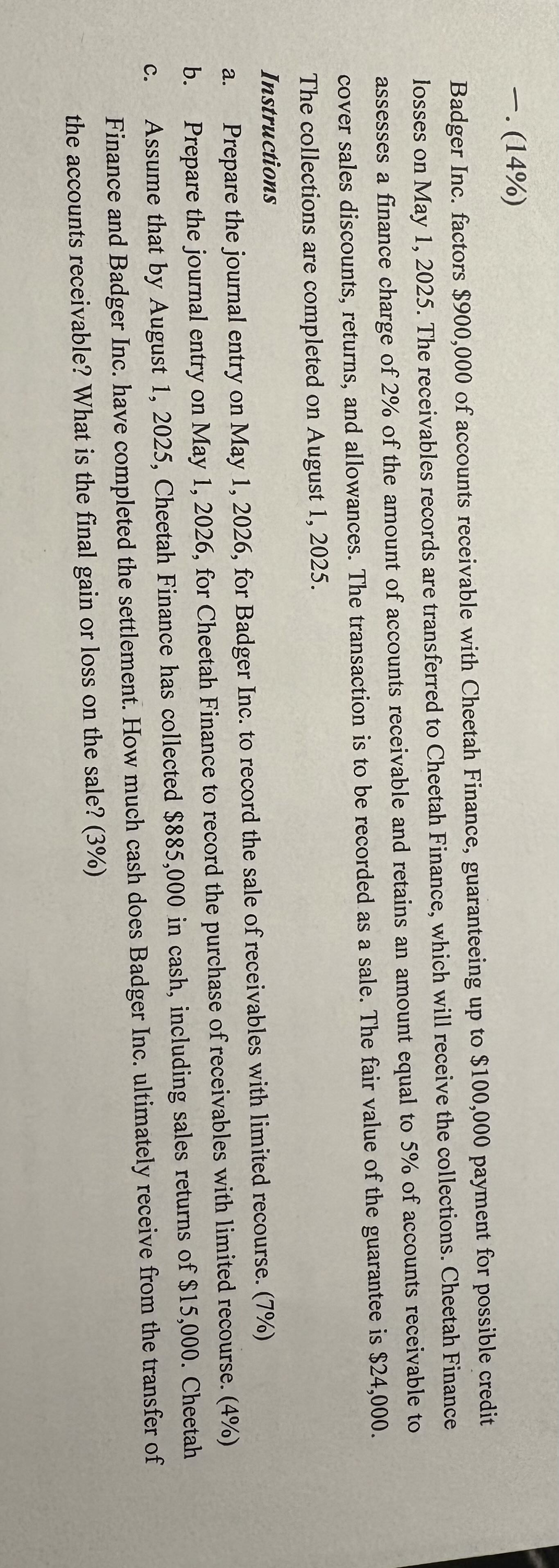

Question: - . ( 1 4 % ) Badger Inc. factors ( $ 9 0 0 , 0 0 0 ) of

Badger Inc. factors $ of accounts receivable with Cheetah Finance, guaranteeing up to $ payment for possible credit losses on May The receivables records are transferred to Cheetah Finance, which will receive the collections. Cheetah Finance assesses a finance charge of of the amount of accounts receivable and retains an amount equal to of accounts receivable to cover sales discounts, returns, and allowances. The transaction is to be recorded as a sale. The fair value of the guarantee is $ The collections are completed on August Instructions a Prepare the journal entry on May for Badger Inc. to record the sale of receivables with limited recourse. b Prepare the journal entry on May for Cheetah Finance to record the purchase of receivables with limited recourse. c Assume that by August Cheetah Finance has collected $ in cash, including sales returns of $ Cheetah Finance and Badger Inc. have completed the settlement. How much cash does Badger Inc. ultimately receive from the transfer of the accounts receivable? What is the final gain or loss on the sale?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock