Question: 1. (4 points) Comparing forward and futures contracts, we can say that a. forward contracts are traded on organized exchanges while futures contracts are traded

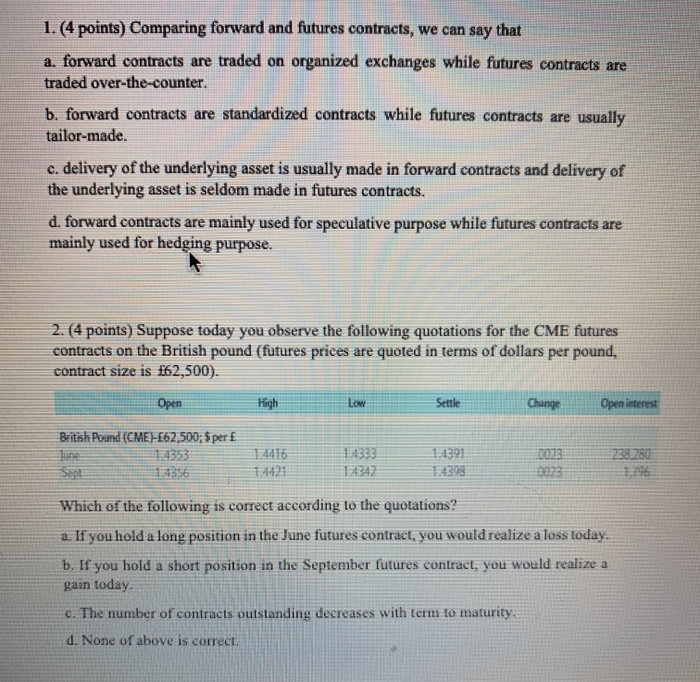

1. (4 points) Comparing forward and futures contracts, we can say that a. forward contracts are traded on organized exchanges while futures contracts are traded over-the-counter. b. forward contracts are standardized contracts while futures contracts are usually tailor-made. c. delivery of the underlying asset is usually made in forward contracts and delivery of the underlying asset is seldom made in futures contracts. d. forward contracts are mainly used for speculative purpose while futures contracts are mainly used for hedging purpose. 2. (4 points) Suppose today you observe the following quotations for the CME futures contracts on the British pound (futures prices are quoted in terms of dollars per pound, contract size is 162,500). Open Settle Change Open interest British Pound (CME)-62,500; 5 per : 1.1391 1336 Which of the following is correct according to the quotations? a. If you hold a long position in the June futures contract, you would realize a loss today. b. If you hold a short position in the September futures contract, you would realize a gain today. c. The number of contracts outstanding decreases with term to maturity. d. None of above is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts