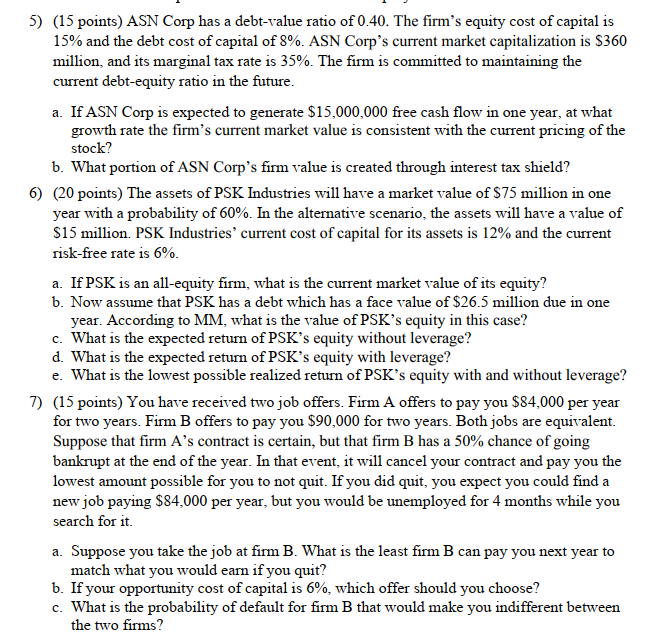

Question: ( 1 5 points ) ASN Corp has a debt - value ratio of 0 . 4 0 . The firm's equity cost of capital

points ASN Corp has a debtvalue ratio of The firm's equity cost of capital is

and the debt cost of capital of ASN Corp's current market capitalization is $

million, and its marginal tax rate is The firm is committed to maintaining the

current debtequity ratio in the future.

a If ASN Corp is expected to generate $ free cash flow in one year, at what

growth rate the firm's current market value is consistent with the current pricing of the

stock?

b What portion of ASN Corp's firm value is created through interest tax shield?

points The assets of PSK Industries will have a market value of $ million in one

year with a probability of In the alternative scenario, the assets will have a value of

$ million. PSK Industries' current cost of capital for its assets is and the current

riskfree rate is

a If PSK is an allequity firm, what is the current market value of its equity?

b Now assume that PSK has a debt which has a face value of $ million due in one

year. According to MM what is the value of PSKs equity in this case?

c What is the expected return of PSKs equity without leverage?

d What is the expected return of PSKs equity with leverage?

e What is the lowest possible realized return of PSKs equity with and without leverage?

points You have received two job offers. Firm A offers to pay you $ per year

for two years. Firm B offers to pay you $ for two years. Both jobs are equivalent.

Suppose that firm As contract is certain, but that firm B has a chance of going

bankrupt at the end of the year. In that event, it will cancel your contract and pay you the

lowest amount possible for you to not quit. If you did quit, you expect you could find a

new job paying $ per year, but you would be unemployed for months while you

search for it

a Suppose you take the job at firm B What is the least firm B can pay you next year to

match what you would earn if you quit?

b If your opportunity cost of capital is which offer should you choose?

c What is the probability of default for firm B that would make you indifferent between

the two firms?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock