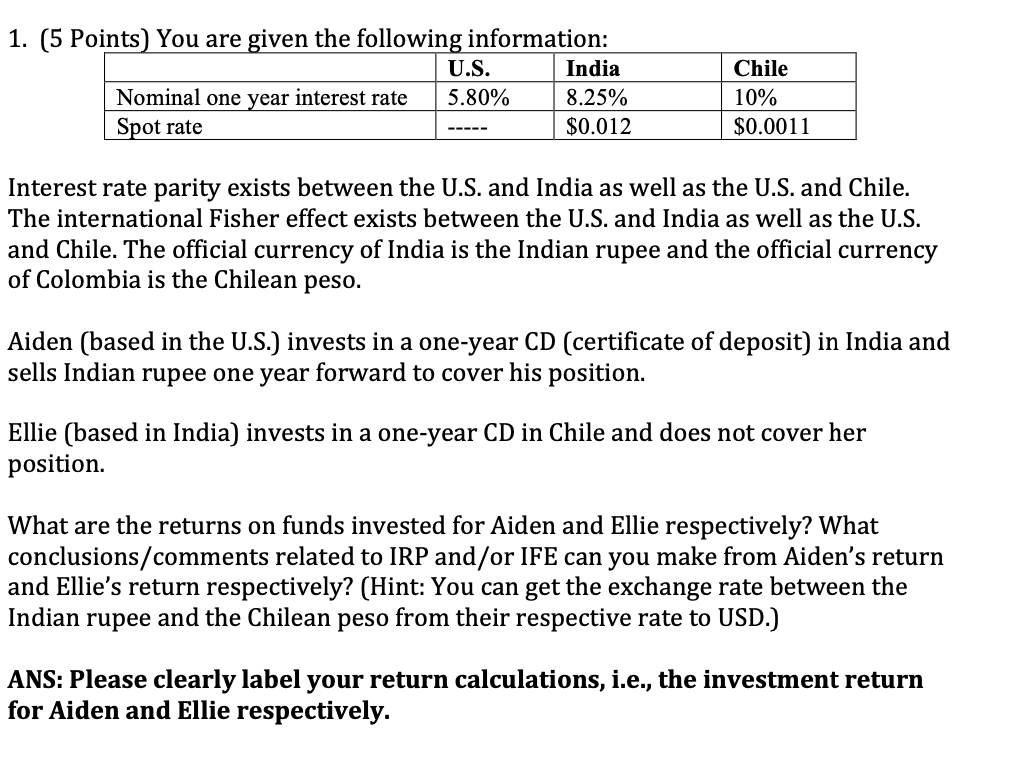

Question: 1 . ( 5 Points ) You are given the following information: Interest rate parity exists between the U . S . and India as

Points You are given the following information:

Interest rate parity exists between the US and India as well as the US and Chile. The international Fisher effect exists between the US and India as well as the US and Chile. The official currency of India is the Indian rupee and the official currency of Colombia is the Chilean peso.

Aiden based in the US invests in a oneyear CD certificate of deposit in India and sells Indian rupee one year forward to cover his position.

Ellie based in India invests in a oneyear CD in Chile and does not cover her position.

What are the returns on funds invested for Aiden and Ellie respectively? What conclusionscomments related to IRP andor IFE can you make from Aiden's return and Ellie's return respectively? Hint: You can get the exchange rate between the Indian rupee and the Chilean peso from their respective rate to USD.

ANS: Please clearly label your return calculations, ie the investment return for Aiden and Ellie respectively.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock