Question: Sombie Datoo operates an Exotic fish pond construction business called Mandhari Enterprise. Some clients are required to pay in advance for the services, while

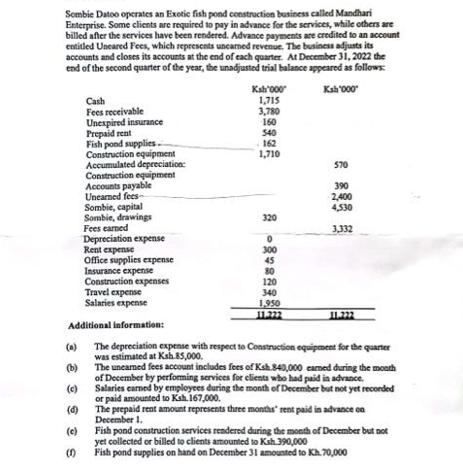

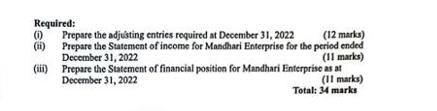

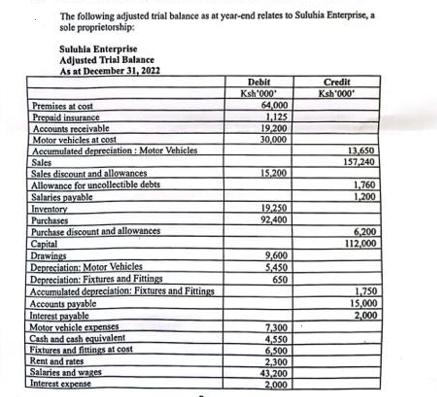

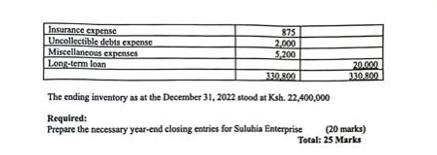

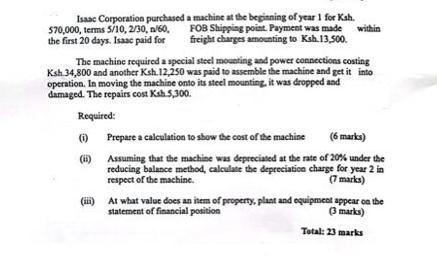

Sombie Datoo operates an Exotic fish pond construction business called Mandhari Enterprise. Some clients are required to pay in advance for the services, while others are billed after the services have been rendered. Advance payments are credited to an account entitled Uneared Fees, which represents uncarned revenue. The business adjusts its accounts and closes its accounts at the end of each quarter. At December 31, 2022 the end of the second quarter of the year, the unadjusted trial balance appeared as follows: Ksh '000 3 Cash Fees receivable (b) (c) (d) (c) (10) Unexpired insurance Prepaid rent Fish pond supplies. Construction equipment Accumulated depreciation: Construction equipment Accounts payable Unearned fees- Sombie, capital Sombie, drawings Fees earned Depreciation expense Rent expense Office supplies expense Insurance expense Construction expenses Travel expense Salaries expense Kah'000 1,715 3,780 160 540 162 1,710 320 0 300 45 80 120 340 1,950 11.222 570 Additional information: The depreciation expense with respect to Construction equipment for the quarter was estimated at Ksh.85,000, The unearned fees account includes fees of Ksh.840,000 earned during the month of December by performing services for clients who had paid in advance. Salaries earned by employees during the month of December but not yet recorded or paid amounted to Ksh.167,000. The prepaid rent amount represents three months' rent paid in advance on December 1. 390 2,400 4,530 3,332 Fish pond construction services rendered during the month of December but not yet collected or billed to clients amounted to Ksh.390,000 Fish pond supplies on hand on December 31 amounted to Kh.70,000 Required: (1) (ii) (iii) Prepare the adjusting entries required at December 31, 2022 (12 marks) Prepare the Statement of income for Mandhari Enterprise for the period ended December 31, 2022 (11 marks) Prepare the Statement of financial position for Mandhari Enterprise as at December 31, 2022 (11 marks) Total: 34 marks 2. The following adjusted trial balance as at year-end relates to Suluhia Enterprise, a sole proprietorship: Suluhia Enterprise Adjusted Trial Balance As at December 31, 2022 Premises at cost Prepaid insurance Accounts receivable Motor vehicles at cost Accumulated depreciation: Motor Vehicles Sales Sales discount and allowances Allowance for uncollectible debts Salaries payable Inventory Purchases Purchase discount and allowances Capital Drawings Depreciation: Motor Vehicles Depreciation: Fixtures and Fittings Accumulated depreciation: Fixtures and Fittings Accounts payable Interest payable Motor vehicle expenses Cash and cash equivalent Fixtures and fittings at cost Rent and rates Salaries and wages Interest expense Debit Ksh'000' 64,000 1,125 19,200 30,000 15,200 19.250 92,400 9,600 5,450 650 7,300 4,550 6,500 2,300 43,200 2,000 Credit Ksh'000 13.650 157,240 1,760 1,200 6,200 112,000 1,750 15,000 2,000 Insurance expense Uncollectible debts expense Miscellaneous expenses Long-term loan 875 2,000 5,200 20.000 330.800 330,800 The ending inventory as at the December 31, 2022 stood at Ksh. 22,400,000 Required: Prepare the necessary year-end closing entries for Suluhia Enterprise (20 marks) Total: 25 Marks 3. Isaac Corporation purchased 570,000, terms 5/10, 2/30, 60, the first 20 days. Isaac paid for a machine at the beginning of year 1 for Ksh. FOB Shipping point. Payment was made freight charges amounting to Ksh.13,500. (i) (ii) within The machine required a special steel mounting and power connections costing Ksh.34,800 and another Ksh.12,250 was paid to assemble the machine and get it into operation. In moving the machine onto its steel mounting, it was dropped and damaged. The repairs cost Ksh 5,300. Required: Prepare a calculation to show the cost of the machine (6 marks) Assuming that the machine was depreciated at the rate of 20% under the reducing balance method, calculate the depreciation charge for year 2 in respect of the machine. (7 marks) (iii) At what value does an item of property, plant and equipment appear on the statement of financial position (3 marks) Total: 23 marks

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

To prepare the adjusting entries statement of income and statement of financial position for Mandhari Enterprise I will use the additional information ... View full answer

Get step-by-step solutions from verified subject matter experts