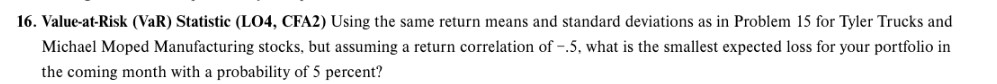

Question: 1 6 . Value - at - Risk ( VaR ) Statistic ( LO 4 , CFA 2 ) Using the same return means and

ValueatRisk VaR Statistic LO CFA Using the same return means and standard deviations as in Problem for Tyler Trucks and Michael Moped Manufacturing stocks, but assuming a return correlation of what is the smallest expected loss for your portfolio in the coming month with a probability of percent?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock