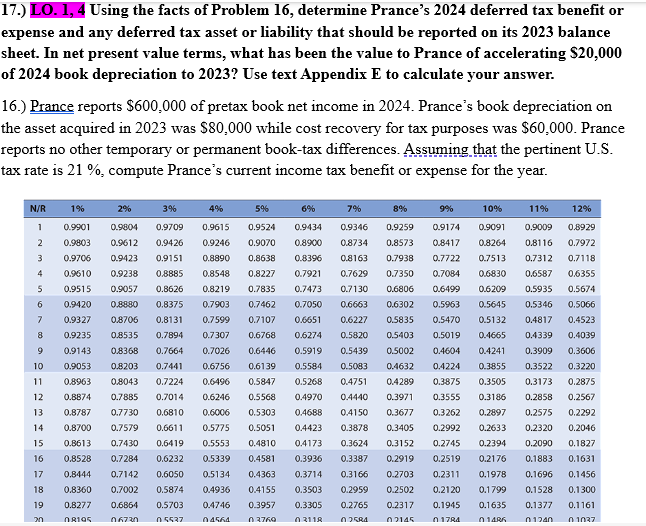

Question: 1 7 . ) LO . 1 , 4 Using the facts of Problem 1 6 , determine Prance s 2 0 2 4 deferred

LO Using the facts of Problem determine Prances deferred tax benefit or expense and any deferred tax asset or liability that should be reported on its balance sheet. In net present value terms, what has been the value to Prance of accelerating $ of book depreciation to Use text Appendix E to calculate your answer. Prance reports $ of pretax book net income in Prances book depreciation on the asset acquired in was $ while cost recovery for tax purposes was $ Prance reports no other temporary or permanent booktax differences. Assuming that the pertinent US tax rate is compute Prances current income tax benefit or expense for the year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock