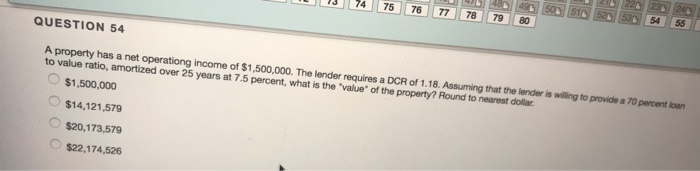

Question: - 1 74 75 76 77 78 79 80 QUESTION 54 A property has a net operationg income of $1,500,000. The lender requires a DCR

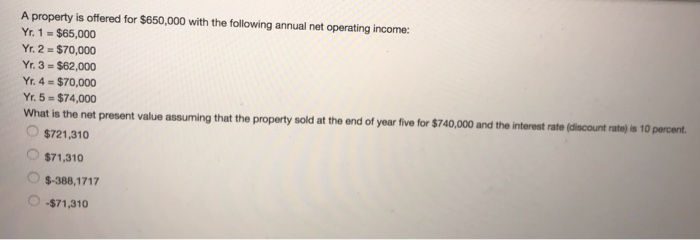

- 1 74 75 76 77 78 79 80 QUESTION 54 A property has a net operationg income of $1,500,000. The lender requires a DCR of 1.18. Assuming that the lender is willing to provide a 70 percento to value ratio, amortized over 25 years at 7.5 percent, what is the "value of the property? Round to nearest dollar $1,500,000 $14,121,579 $20,173,579 De A property is offered for $650,000 with the following annual net operating income: Yr. 1 = $65,000 Yr. 2 = $70,000 Yr. 3 = $62,000 Yr. 4 = $70,000 Yr. 5 - $74,000 What is the net present value assuming that the property sold at the end of year five for $740,000 and the interest rate (discount rate is 10 percent $721,310 $71,310 $-388,1717 O $71,310

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts