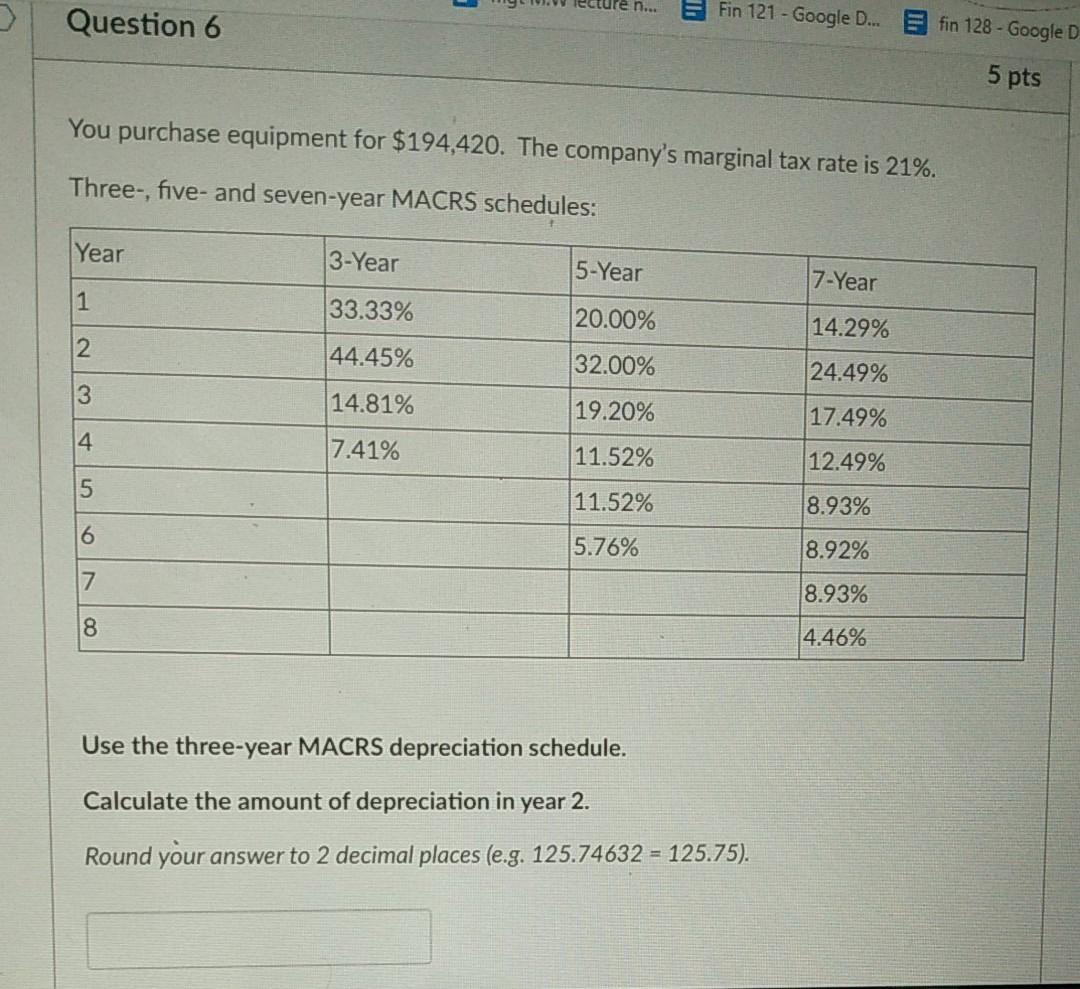

Question: n... Question 6 Fin 121 - Google D... fin 128 - Google D 5 pts You purchase equipment for $194,420. The company's marginal tax rate

n... Question 6 Fin 121 - Google D... fin 128 - Google D 5 pts You purchase equipment for $194,420. The company's marginal tax rate is 21%. Three-, five- and seven-year MACRS schedules: Year 3-Year 5-Year 7-Year 1 33.33% 20.00% 14.29% 2 44.45% 32.00% 24.49% 3 14.81% 19.20% 17.49% 4 7.41% 11.52% 12.49% 5 11.52% 8.93% 16 5.76% 8.92% 7 8.93% 8 4.46% Use the three-year MACRS depreciation schedule. Calculate the amount of depreciation in year 2. Round your answer to 2 decimal places (e.g. 125.74632 - 125.75)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts