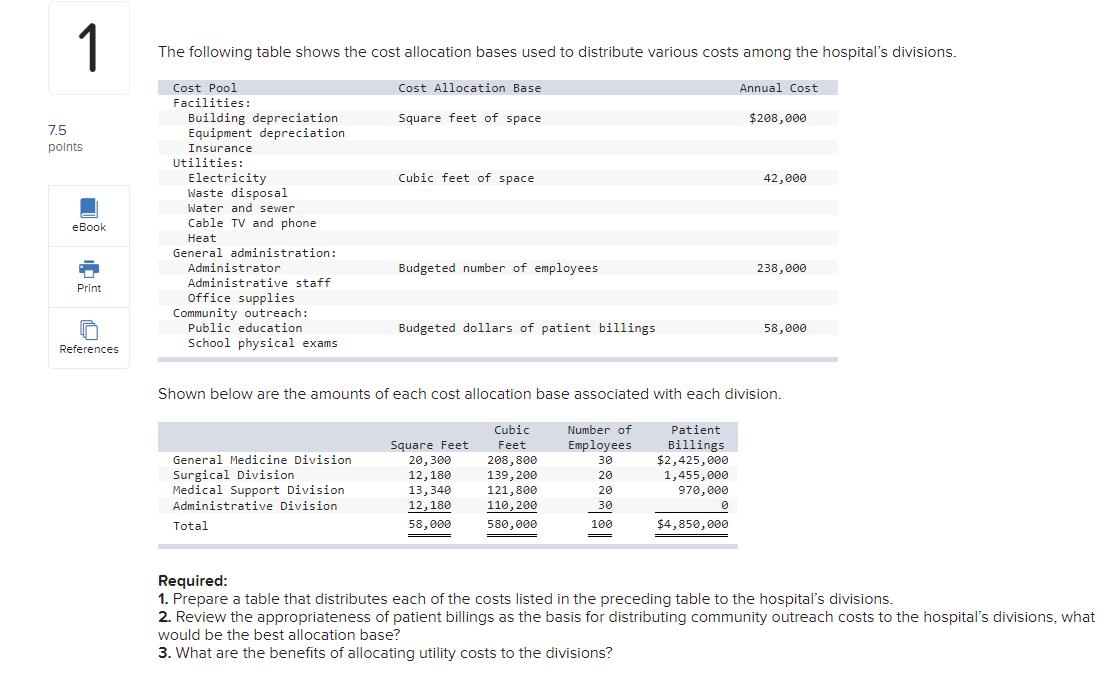

Question: 1 7.5 points eBook Print References The following table shows the cost allocation bases used to distribute various costs among the hospital's divisions. Cost

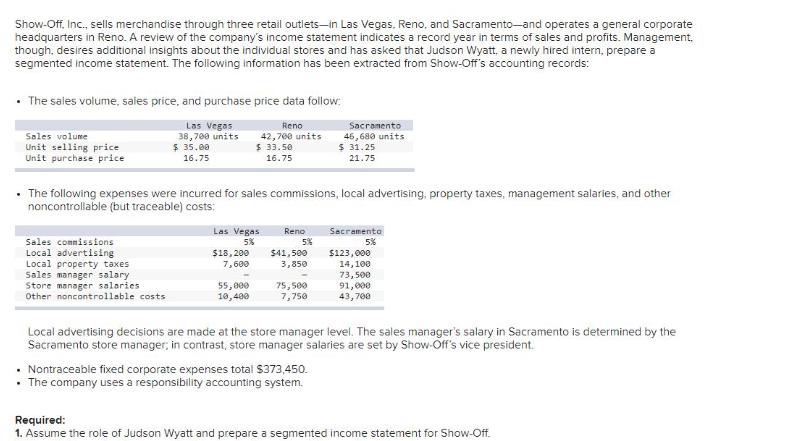

1 7.5 points eBook Print References The following table shows the cost allocation bases used to distribute various costs among the hospital's divisions. Cost Pool Facilities: Building depreciation Equipment depreciation Insurance Utilities: Electricity Waste disposal Water and sewer Cable TV and phone Heat General administration: Administrator Administrative staff office supplies Community outreach: Public education School physical exams General Medicine Division Surgical Division Medical Support Division Administrative Division Cost Allocation Base Square feet of space Total Cubic feet of space Budgeted number of employees Budgeted dollars of patient billings Square Feet 20,300 12,180 13, 340 12,180 58,000 Cubic Feet 208,800 139,200 121,800 110,200 580,000 Shown below are the amounts of each cost allocation base associated with each division. Patient Billings. $2,425,000 1,455,000 970,000 Number of Employees 30 20 20 30 100 0 Annual Cost $4,850,000 $208,000 42,000 238,000 58,000 Required: 1. Prepare a table that distributes each of the costs listed in the preceding table to the hospital's divisions. 2. Review the appropriateness of patient billings as the basis for distributing community outreach costs to the hospital's divisions, what would be the best allocation base? 3. What are the benefits of allocating utility costs to the divisions? Show-Off, Inc., sells merchandise through three retail outlets in Las Vegas, Reno, and Sacramento-and operates a general corporate headquarters in Reno. A review of the company's income statement indicates a record year in terms of sales and profits. Management. though, desires additional insights about the individual stores and has asked that Judson Wyatt, a newly hired intern, prepare a segmented income statement. The following information has been extracted from Show-Off's accounting records: The sales volume, sales price, and purchase price data follow: Las Vegas 38,700 units Reno 42,700 units $ 33.50 16.75 $ 35.00 16.75 Sales volume Unit selling price Unit purchase price The following expenses were incurred for sales commissions, local advertising, property taxes, management salaries, and other noncontrollable (but traceable) costs: Sales commissions Local advertising Local property taxes Sales manager salary Store manager salaries Other noncontrollable costs Las Vegas 5% $18,200 7,600 55,000 10,400 Reno Secr mento 5% 5% $41,500 3,850 Sacramento 46,680 units $ 31.25 21.75 75,500 7,750 Nontraceable fixed corporate expenses total $373,450. The company uses a responsibility accounting system. $123,000 14,100 73,500 91,000 43,700 Local advertising decisions are made at the store manager level. The sales manager's salary in Sacramento is determined by the Sacramento store manager; in contrast, store manager salaries are set by Show-Off's vice president. Required: 1. Assume the role of Judson Wyatt and prepare a segmented income statement for Show-Off.

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts