Question: 1 8 : 0 4 5 G Assignment 7 : Attempt 1 SHORT - TERM FINANCING, OPTIONS 1 8 : 0 4 5 G Assignment

:

G

Assignment : Attempt

SHORTTERM FINANCING, OPTIONS :

G

Assignment : Attempt

SHORTTERM FINANCING, OPTIONS

:

G

Assignment : Attempt

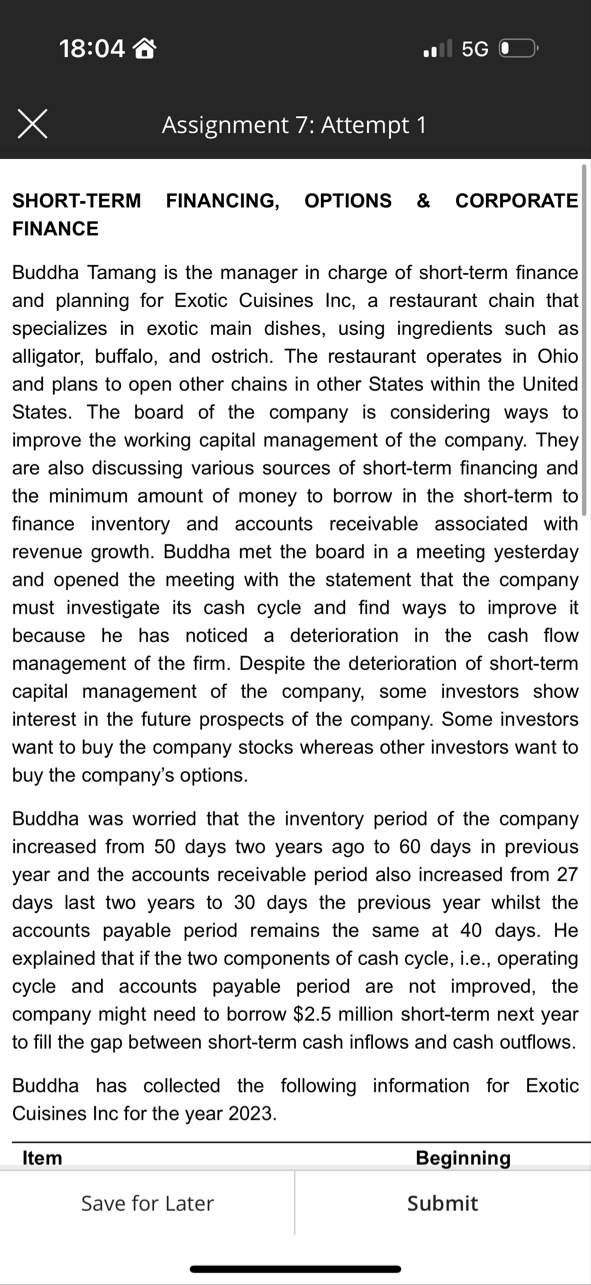

SHORTTERM FINANCING, OPTIONS & CORPORATE FINANCE

Buddha Tamang is the manager in charge of shortterm finance and planning for Exotic Cuisines Inc, a restaurant chain that specializes in exotic main dishes, using ingredients such as alligator, buffalo, and ostrich. The restaurant operates in Ohio and plans to open other chains in other States within the United States. The board of the company is considering ways to improve the working capital management of the company. They are also discussing various sources of shortterm financing and the minimum amount of money to borrow in the shortterm to finance inventory and accounts receivable associated with revenue growth. Buddha met the board in a meeting yesterday and opened the meeting with the statement that the company must investigate its cash cycle and find ways to improve it because he has noticed a deterioration in the cash flow management of the firm. Despite the deterioration of shortterm capital management of the company, some investors show interest in the future prospects of the company. Some investors want to buy the company stocks whereas other investors want to buy the company's options.

Buddha was worried that the inventory period of the company increased from days two years ago to days in previous year and the accounts receivable period also increased from days last two years to days the previous year whilst the accounts payable period remains the same at days. He explained that if the two components of cash cycle, ie operating cycle and accounts payable period are not improved, the company might need to borrow $ million shortterm next year to fill the gap between shortterm cash inflows and cash outflows.

Buddha has collected the following information for Exotic Cuisines Inc for the year

tableItemBeginningSave for Later,Submit

:

G

Assignment : Attempt

exprained that in the two components or cash cycle, le operating cycle and accounts payable period are not improved, the company might need to borrow $ million shortterm next year to fill the gap between shortterm cash inflows and cash outflows.

Buddha has collected the following information for Exotic Cuisines Inc for the year

tableItemBeginningInventoryAccounts receivable,Accounts payable,

Credit sales for the year just ended were $ and the cost of goods sold was $

Buddha explained that the company can change some aspects of its shortterm financial policy and find alternative financing policies to fund current assets to improve its working capital management.

Calculate the following utilization ie asset management ratios for Exotic Cuisines Inc.

i inventory period

ii receivables period

iii. payables period

Using the utilization ratios, the board chair wants you to calculate the following and explain what they mean:

i Operating cycle of the company for

ii Cash cycle of the company for

Propose three ways to improve the company's cash cycle.

Save for Later

Submit

:

G

Assignment : Attempt

The company wants to increase its cash position. Explain to the board whether the following activities increase or decrease cash:

i increasing longterm debt

ii increasing current liabilities

iii. increasing current assets other than cash

iv increasing equity ie selling some stock

v increasing cash dividend payments

The board is concerned that the net working capital might be declining and not meet the $ million minimum requirement of the company. The company has a cash balance of $ million and other current assets of $ million and current liabilities of $ million. Should the board worry about the company's net working capital?

The cash budget shows that Exotic Cuisines will need $ million to finance its working capital needs in the next three years. List five sources of shortterm financing the company can use to raise money.

Timothy Thompson aka TT is planning to invest in Exotic Cuisines Inc. He anticipates a decline in the stock price of the company because of weak liquidity and profitability ratios. However, because of declining inflation, rising economic growth, and favorable GDP figures, he is not certain of the direction of the company's stock. He wants to use options to hedge his investment risk. Unfortunately, he does not understand options as used in corporate finance and investment management.

i explain call option

ii explain put option

iii. explain the circumstances under which TT will want to buy each of the options.

Save for Later

Submit

:

Ill

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock