Question: > 1 8 Q6-DT (3) - Microsoft Excel File Hamp Insert Page Layout Formulas DATA Review View A Cut Calbi A Wrap Test General 2

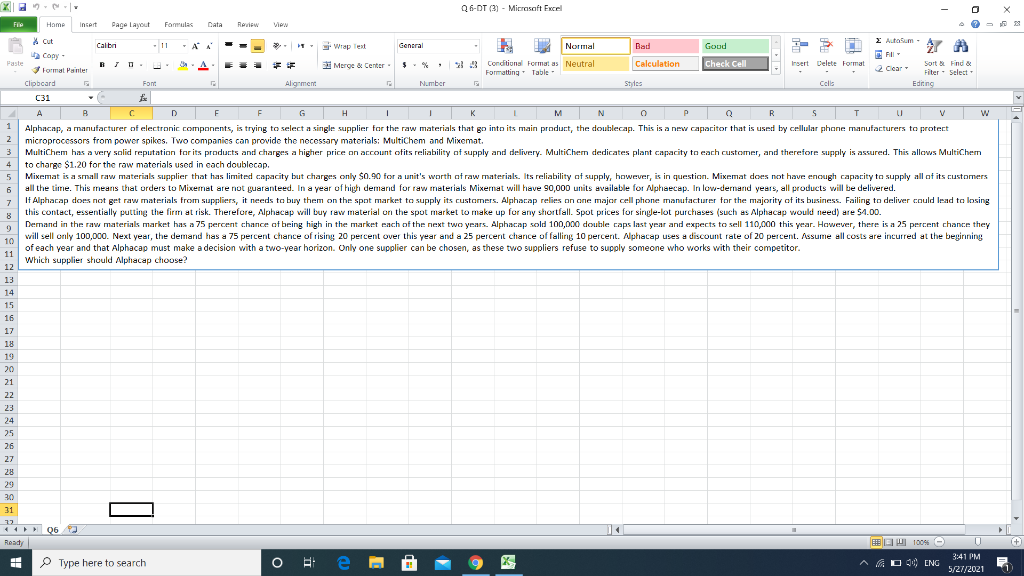

> 1 8 Q6-DT (3) - Microsoft Excel File Hamp Insert Page Layout Formulas DATA Review View A Cut Calbi A Wrap Test General 2 Auta Sum- Normal Bad Goud 1 Copy CFL Paste Merge & Center $ 3 Conditional Formatas Neutral Format Painter Calculation Check Cell Insert Delete Format Sort BL Find & a Formatting Table Clear Fiter. Select Clipboard Font Alignment Number Styles Cells Editing C31 & A B CDF F H 1 IK MN 0 P R STU VW 1 Alphacap, a manufacturer of electronic components, is trying to select a single supplier for the raw materials that go into its main product, the doublecap. This is a new capacitor that is used by cellular phone manufacturers to protect 2 microprocessors from power spikes. Two companies can provide the necessary materials: MultiChem and Mixemat. 3 MultiChem has a very solid reputation for its products and charges a higher price on account ofits reliability of supply and delivery. MultiChem dedicates plant capacity to each customer, and therefore supply is assured. This allows MultiChem 4 to change $1.20 for the raw materials used in each doublecap. 5 Mixemat is a small raw materials supplier that has limited capacity but charges only $0.90 for a unit's worth of raw materials. Its reliability of supply, however, is in question. Mixemat does not have enough capacity to supply all of its customers 6 all the time. This means that orders to Mixemat are not guaranteed. In a year of high demand for raw materials Mixerat will have 90,000 units available for Alphaecap. In low-demnand years, all products will be delivered. 7 It Alphacap does not get raw materials from suppliers, it needs to buy them on the spot market to supply its customers. Alphacap relies on one major cell phone manufacturer for the majority of its business. Failing to deliver could lead to losing this contact, essentially putting the firm at risk. Therefore, Alphecep will buy raw material on the spot market to make up for any shortfall. Spot prices for single-lot purchases (such as Alphacap would need) are $4.00. 9 Demand in the raw materials market has a 75 percent chance of being high in the market each of the next two years. Alphacap sold 100,000 double caps last year and expects to sell 110,000 this year. However, there is a 25 percent chance they 10 will sell only 100,000. Next year, the demand has a 75 percent chance of rising 20 percent over this year and a 25 percent chance of falling 10 percent. Alphacap uses a discount rate of 20 percent. Assume all costs are incurred at the beginning 11 of each year and that Alphacap must make a decision with a two-year horizon. Only one supplier can be chosen, as these two suppliers refuse to supply someone who works with their competitor. Which supplier should Alphacap choose? 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 22 4.06 Q6 2 Ready BBW 100% Type here to search 3:41 PM X AD ENG 5/27/2021 S + > 1 8 Q6-DT (3) - Microsoft Excel File Hamp Insert Page Layout Formulas DATA Review View A Cut Calbi A Wrap Test General 2 Auta Sum- Normal Bad Goud 1 Copy CFL Paste Merge & Center $ 3 Conditional Formatas Neutral Format Painter Calculation Check Cell Insert Delete Format Sort BL Find & a Formatting Table Clear Fiter. Select Clipboard Font Alignment Number Styles Cells Editing C31 & A B CDF F H 1 IK MN 0 P R STU VW 1 Alphacap, a manufacturer of electronic components, is trying to select a single supplier for the raw materials that go into its main product, the doublecap. This is a new capacitor that is used by cellular phone manufacturers to protect 2 microprocessors from power spikes. Two companies can provide the necessary materials: MultiChem and Mixemat. 3 MultiChem has a very solid reputation for its products and charges a higher price on account ofits reliability of supply and delivery. MultiChem dedicates plant capacity to each customer, and therefore supply is assured. This allows MultiChem 4 to change $1.20 for the raw materials used in each doublecap. 5 Mixemat is a small raw materials supplier that has limited capacity but charges only $0.90 for a unit's worth of raw materials. Its reliability of supply, however, is in question. Mixemat does not have enough capacity to supply all of its customers 6 all the time. This means that orders to Mixemat are not guaranteed. In a year of high demand for raw materials Mixerat will have 90,000 units available for Alphaecap. In low-demnand years, all products will be delivered. 7 It Alphacap does not get raw materials from suppliers, it needs to buy them on the spot market to supply its customers. Alphacap relies on one major cell phone manufacturer for the majority of its business. Failing to deliver could lead to losing this contact, essentially putting the firm at risk. Therefore, Alphecep will buy raw material on the spot market to make up for any shortfall. Spot prices for single-lot purchases (such as Alphacap would need) are $4.00. 9 Demand in the raw materials market has a 75 percent chance of being high in the market each of the next two years. Alphacap sold 100,000 double caps last year and expects to sell 110,000 this year. However, there is a 25 percent chance they 10 will sell only 100,000. Next year, the demand has a 75 percent chance of rising 20 percent over this year and a 25 percent chance of falling 10 percent. Alphacap uses a discount rate of 20 percent. Assume all costs are incurred at the beginning 11 of each year and that Alphacap must make a decision with a two-year horizon. Only one supplier can be chosen, as these two suppliers refuse to supply someone who works with their competitor. Which supplier should Alphacap choose? 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 22 4.06 Q6 2 Ready BBW 100% Type here to search 3:41 PM X AD ENG 5/27/2021 S +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts