Question: 1. A 9% Rs. 100 face value debentures, having a provision for redemption at a premium of 5% at the end of 5 year

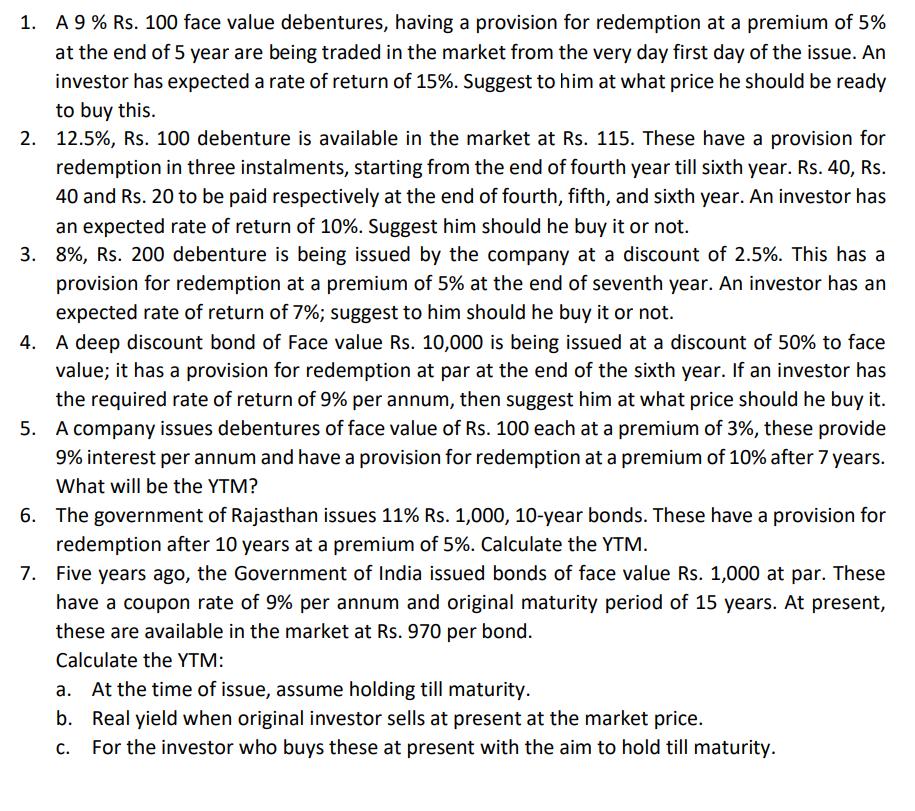

1. A 9% Rs. 100 face value debentures, having a provision for redemption at a premium of 5% at the end of 5 year are being traded in the market from the very day first day of the issue. An investor has expected a rate of return of 15%. Suggest to him at what price he should be ready to buy this. 2. 12.5%, Rs. 100 debenture is available in the market at Rs. 115. These have a provision for redemption in three instalments, starting from the end of fourth year till sixth year. Rs. 40, Rs. 40 and Rs. 20 to be paid respectively at the end of fourth, fifth, and sixth year. An investor has an expected rate of return of 10%. Suggest him should he buy it or not. 3. 8%, Rs. 200 debenture is being issued by the company at a discount of 2.5%. This has a provision for redemption at a premium of 5% at the end of seventh year. An investor has an expected rate of return of 7%; suggest to him should he buy it or not. 4. A deep discount bond of Face value Rs. 10,000 is being issued at a discount of 50% to face value; it has a provision for redemption at par at the end of the sixth year. If an investor has the required rate of return of 9% per annum, then suggest him at what price should he buy it. 5. A company issues debentures of face value of Rs. 100 each at a premium of 3%, these provide 9% interest per annum and have a provision for redemption at a premium of 10% after 7 years. What will be the YTM? 6. The government of Rajasthan issues 11% Rs. 1,000, 10-year bonds. These have a provision for redemption after 10 years at a premium of 5%. Calculate the YTM. 7. Five years ago, the Government of India issued bonds of face value Rs. 1,000 at par. These have a coupon rate of 9% per annum and original maturity period of 15 years. At present, these are available in the market at Rs. 970 per bond. Calculate the YTM: At the time of issue, assume holding till maturity. b. Real yield when original investor sells at present at the market price. C. For the investor who buys these at present with the aim to hold till maturity.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

1 To calculate the price at which the investor should be ready to buy the debenture Annual coupon payment 9 of Rs 100 Rs 9 Premium at redemption 5 of Rs 100 Rs 5 Future value of Rs 100 after 5 years a... View full answer

Get step-by-step solutions from verified subject matter experts