Question: 1 A bond with a $1,000 par value has an 7.5% coupon rate. It will mature in 5 years, and coupon payments are made semi-annually.

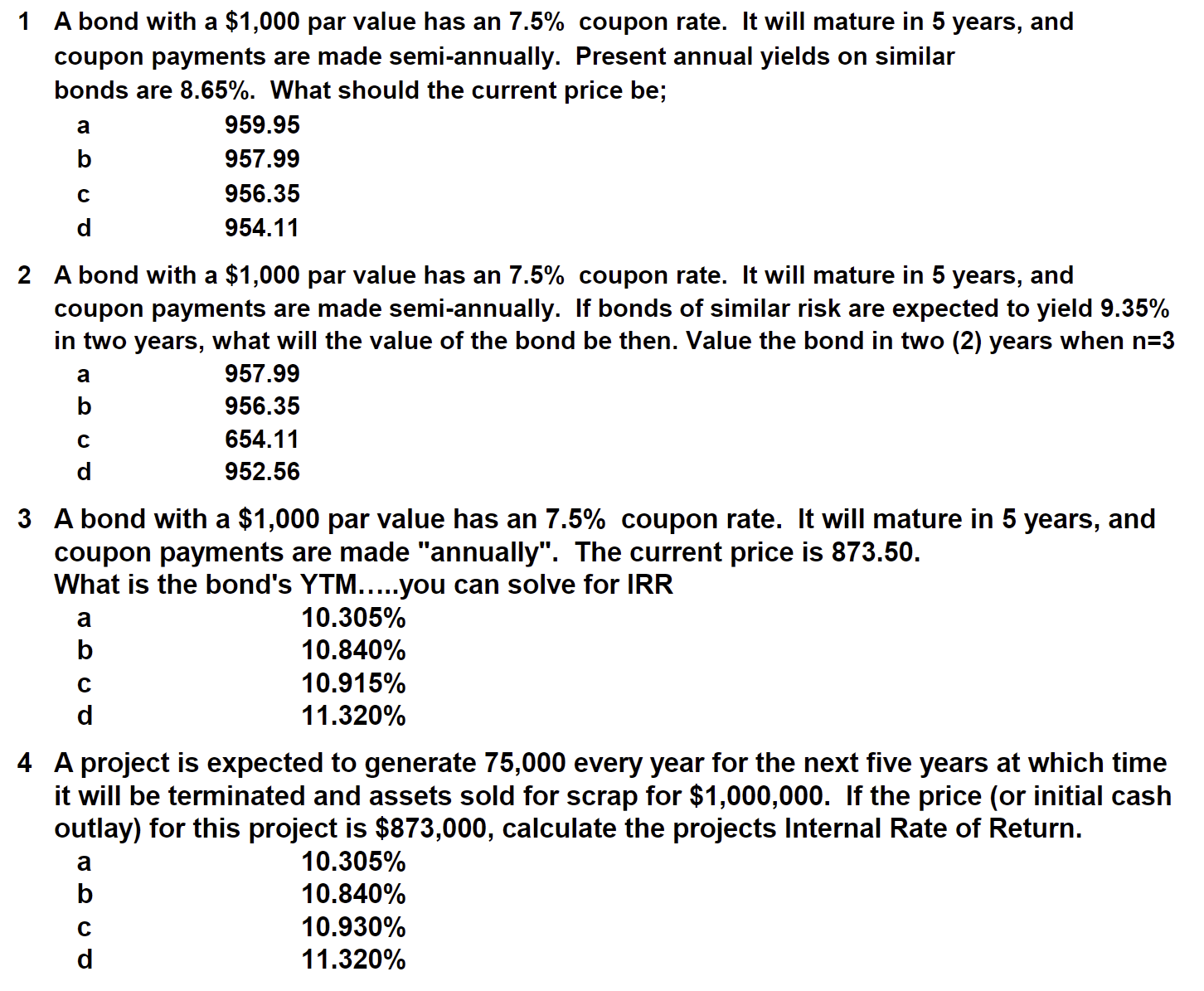

1 A bond with a $1,000 par value has an 7.5% coupon rate. It will mature in 5 years, and coupon payments are made semi-annually. Present annual yields on similar bonds are 8.65%. What should the current price be; abcd959.95957.99956.35954.11 2 A bond with a $1,000 par value has an 7.5% coupon rate. It will mature in 5 years, and coupon payments are made semi-annually. If bonds of similar risk are expected to yield 9.35% in two years, what will the value of the bond be then. Value the bond in two (2) years when n=3 abcd957.99956.35654.11952.56 3 A bond with a $1,000 par value has an 7.5% coupon rate. It will mature in 5 years, and coupon payments are made "annually". The current price is 873.50. What is the bond's YTM.....you can solve for IRR abcd10.305%10.840%10.915%11.320% 4 A project is expected to generate 75,000 every year for the next five years at which time it will be terminated and assets sold for scrap for $1,000,000. If the price (or initial cash outlay) for this project is $873,000, calculate the projects Internal Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts