Question: 3 A bond with a $1,000 par value has an 7.5% coupon rate. It will mature in 5 years, and coupon payments are made annually.

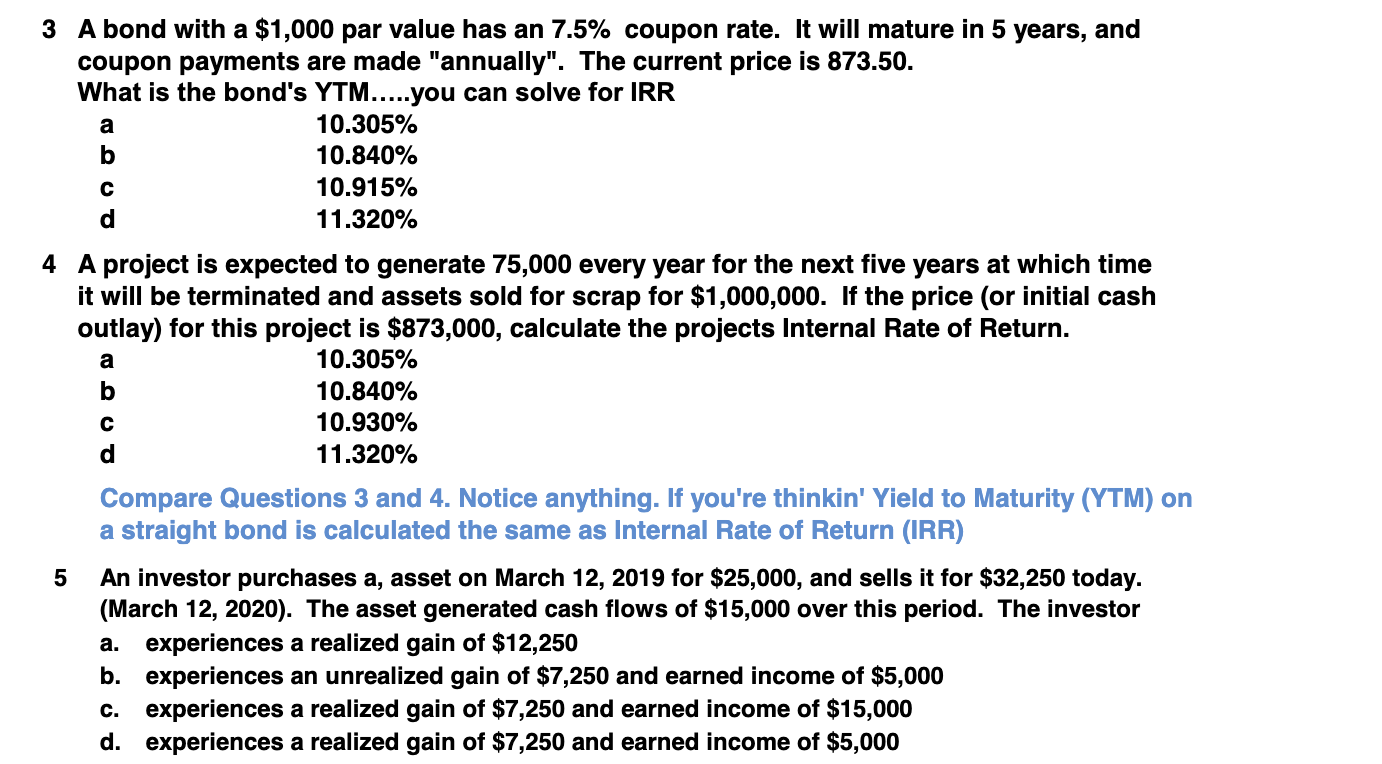

3 A bond with a $1,000 par value has an 7.5% coupon rate. It will mature in 5 years, and coupon payments are made "annually". The current price is 873.50. What is the bond's YTM.....you can solve for IRR 10.305% 10.840% 10.915% 11.320% a oud 4 A project is expected to generate 75,000 every year for the next five years at which time it will be terminated and assets sold for scrap for $1,000,000. If the price (or initial cash outlay) for this project is $873,000, calculate the projects Internal Rate of Return. 10.305% 10.840% 10.930% 11.320% Compare Questions 3 and 4. Notice anything. If you're thinkin' Yield to Maturity (YTM) on a straight bond is calculated the same as Internal Rate of Return (IRR) 5 An investor purchases a, asset on March 12, 2019 for $25,000, and sells it for $32,250 today. (March 12, 2020). The asset generated cash flows of $15,000 over this period. The investor a. experiences a realized gain of $12,250 experiences an unrealized gain of $7,250 and earned income of $5,000 c. experiences a realized gain of $7,250 and earned income of $15,000 d. experiences a realized gain of $7,250 and earned income of $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts