Question: 1. A Company leased a Cloud Computing equipment from Academy Leasing Services on January 1, 2019. Academy Leasing Services paid $454,595 for the equipment. Its

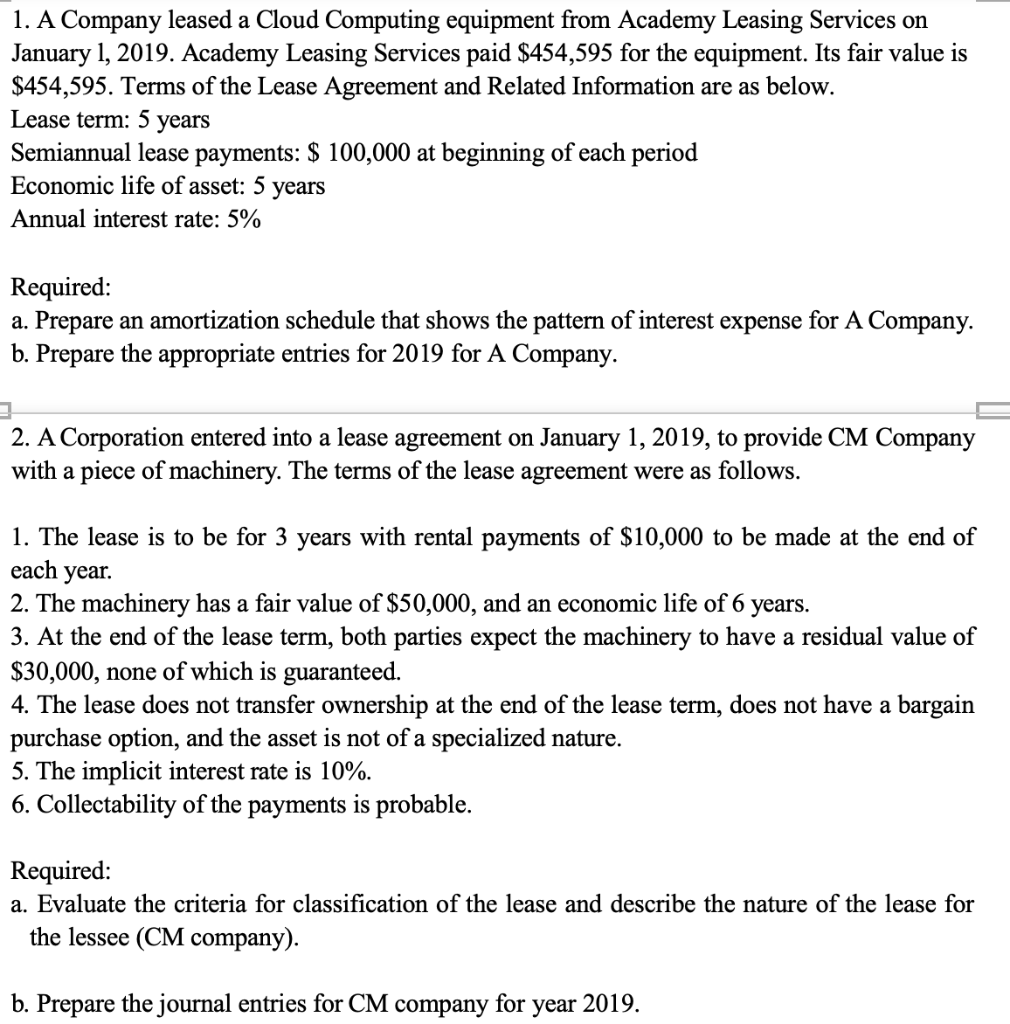

1. A Company leased a Cloud Computing equipment from Academy Leasing Services on January 1, 2019. Academy Leasing Services paid $454,595 for the equipment. Its fair value is $454,595. Terms of the Lease Agreement and Related Information are as below. Lease term: 5 years Semiannual lease payments: $ 100,000 at beginning of each period Economic life of asset: 5 years Annual interest rate: 5% Required: a. Prepare an amortization schedule that shows the pattern of interest expense for A Company. b. Prepare the appropriate entries for 2019 for A Company. 2. A Corporation entered into a lease agreement on January 1, 2019, to provide CM Company with a piece of machinery. The terms of the lease agreement were as follows. 1. The lease is to be for 3 years with rental payments of $10,000 to be made at the end of each year. 2. The machinery has a fair value of $50,000, and an economic life of 6 years. 3. At the end of the lease term, both parties expect the machinery to have a residual value of $30,000, none of which is guaranteed. 4. The lease does not transfer ownership at the end of the lease term, does not have a bargain purchase option, and the asset is not of a specialized nature. 5. The implicit interest rate is 10%. 6. Collectability of the payments is probable. Required: a. Evaluate the criteria for classification of the lease and describe the nature of the lease for the lessee (CM company). b. Prepare the journal entries for CM company for year 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts