Question: 1. A leased a Cloud Computing equipment from Academy Leasing Services on January l, 2019. Academy Leasing Services paid $454,595 for the equipment. Its fair

1. A leased a Cloud Computing equipment from Academy Leasing Services on January l, 2019. Academy Leasing Services paid $454,595 for the equipment. Its fair value is $454,595. Terms of the Lease Agreement and Related Information are as below.

Lease term: 5 years

Semiannual lease payments: $ 100,000 at beginning of each period

Economic life of asset: 5 years

Annual interest rate: 5%

Required:

a. Prepare an amortization schedule that shows the pattern of interest expense for A.

b. Prepare the appropriate entries for 2019 for A.

2. A Corporation entered into a lease agreement on January 1, 2019, to provide CM Company with a piece of machinery. The terms of the lease agreement were as follows.

1. The lease is to be for 3 years with rental payments of $10,000 to be made at the end of each year.

2. The machinery has a fair value of $50,000, and an economic life of 6 years.

3. At the end of the lease term, both parties expect the machinery to have a residual value of $30,000, none of which is guaranteed.

4. The lease does not transfer ownership at the end of the lease term, does not have a bargain purchase option, and the asset is not of a specialized nature.

5. The implicit interest rate is 10%.

6. Collectability of the payments is probable.

Required:

a. Evaluate the criteria for classification of the lease and describe the nature of the lease for the lessee (CM company).

b. Prepare the journal entries for CM company for year 2019.

3.

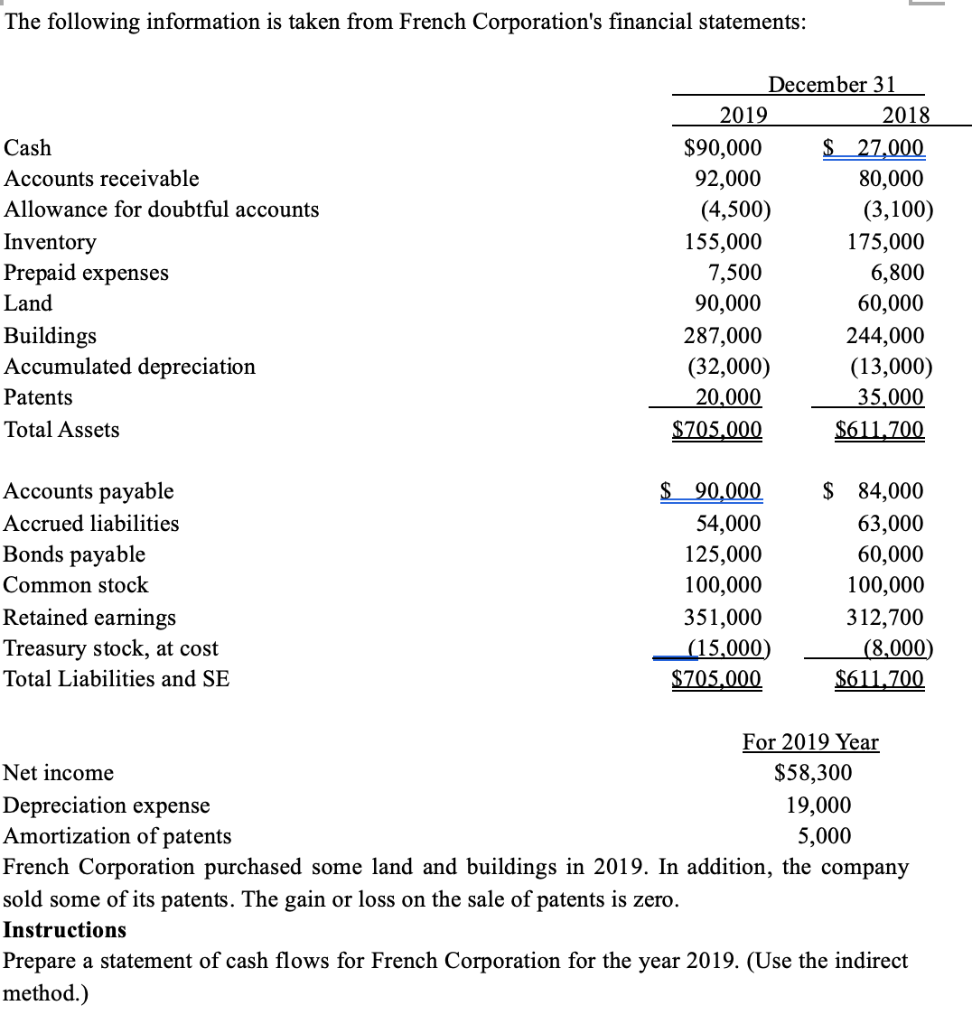

The following information is taken from French Corporation's financial statements: Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Land Buildings Accumulated depreciation Patents Total Assets December 31 2019 | 2018 $90,000 $ 27,000 92,000 80,000 (4,500) (3,100) 155,000 175,000 7,500 6,800 90,000 60,000 287,000 244,000 (32,000) (13,000) 35,000 $705.000 $611,700 20,000 Accounts payable Accrued liabilities Bonds payable Common stock Retained earnings Treasury stock, at cost Total Liabilities and SE $ 90,000 54,000 125,000 100,000 351,000 (15,000) $705,000 $ 84,000 63,000 60,000 100,000 312,700 (8,000) $611.700 For 2019 Year Net income $58,300 Depreciation expense 19,000 Amortization of patents 5,000 French Corporation purchased some land and buildings in 2019. In addition, the company sold some of its patents. The gain or loss on the sale of patents is zero. Instructions Prepare a statement of cash flows for French Corporation for the year 2019. (Use the indirect method.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts