Question: 1. A discount bond differs from a coupon bond in that Market fluctuations may result in capital gains and losses for coupon bonds but not

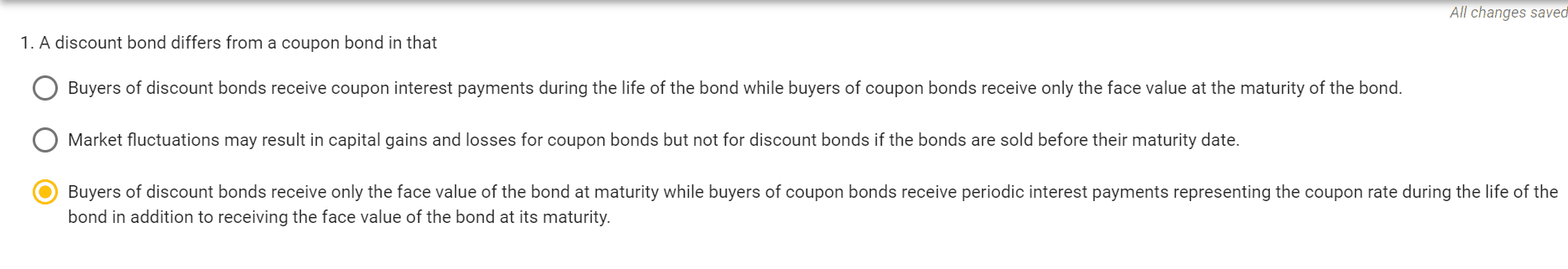

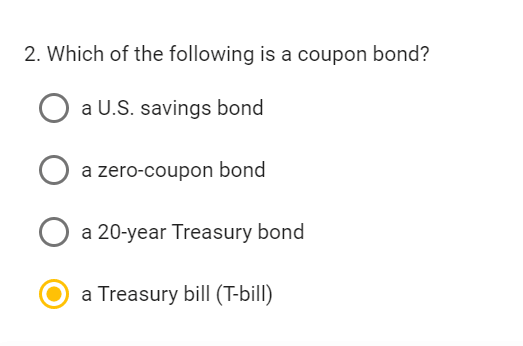

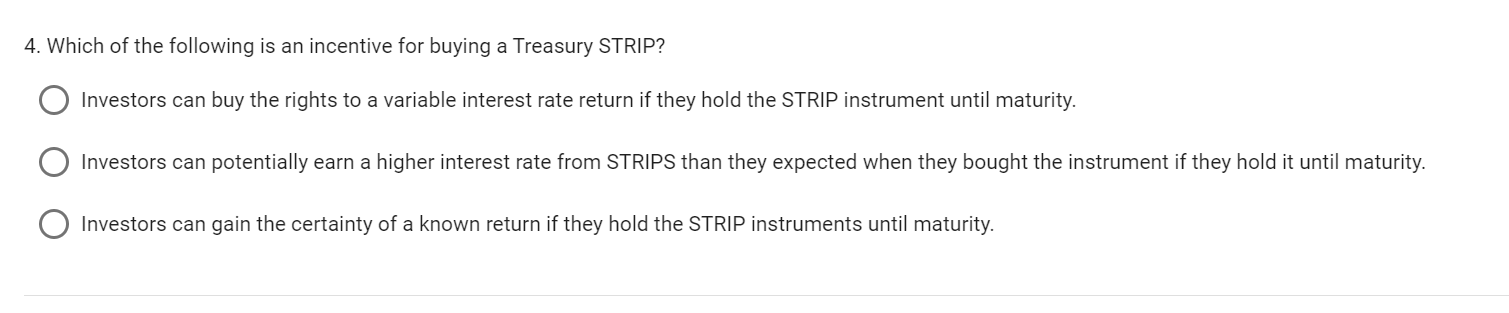

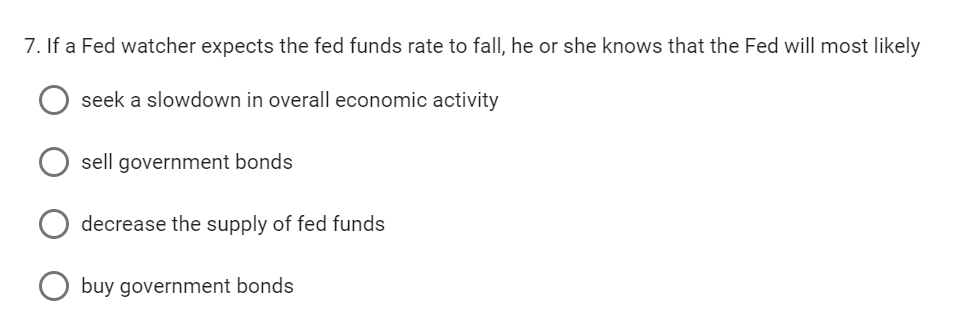

1. A discount bond differs from a coupon bond in that Market fluctuations may result in capital gains and losses for coupon bonds but not for discount bonds if the bonds are sold before the bond in addition to receiving the face value of the bond at its maturity. 2. Which of the following is a coupon bond? a U.S. savings bond a zero-coupon bond a 20-year Treasury bond a Treasury bill (T-bill) 4. Which of the following is an incentive for buying a Treasury STRIP? Investors can buy the rights to a variable interest rate return if they hold the STRIP instrument until maturity. Investors can gain the certainty of a known return if they hold the STRIP instruments until maturity. 7. If a Fed watcher expects the fed funds rate to fall, he or she knows that the Fed will most likely seek a slowdown in overall economic activity sell government bonds decrease the supply of fed funds buy government bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts