Question: 1. a) Fill in the missing numbers in the inventory schedule using the weighted-average cost inventory valuation method. This company uses the perpetual inventory system.

1. a) Fill in the missing numbers in the inventory schedule using the weighted-average cost inventory valuation method. This company uses the perpetual inventory system.

Do not enter dollar signs or commas in the input boxes.

Round all answers to 2 decimal places. All unit cost calculations should be rounded to 2 decimal places as well.

| Inventory Schedule | |||||||

| Purchases | Sales | Balance | |||||

| Transaction | Description | Quantity | Amount | Quantity | Amount | Quantity | Amount |

| Opening Balance | 0 | $ 0 | |||||

| May 5 | Purchase from AAA Co. | 400 | $4,800.00 | Answer | $Answer | Answer | $Answer |

| May 7 | Sale to SSS Co. | Answer | $Answer | Answer | $Answer | 200 | $2,400.00 |

| May 13 | Sale to TTT Co. | Answer | $Answer | 100 | $Answer | Answer | $Answer |

| May 15 | Purchase from BBB Co. | 100 | $1,900.00 | Answer | $Answer | Answer | $Answer |

| May 24 | Sale to UUU Co. | Answer | $Answer | 50 | $Answer | Answer | $Answer |

| May 28 | Purchase from CCC Co. | 60 | $780.00 | Answer | $Answer | Answer | $Answer |

b) If the FIFO method had been used, what would the value of COGS been for the sale to UUU Co.?

COGS = $Answer

c) If the specific identification method had been used, what would the value of COGS been for the sale to UUU Co.? Assume all the units were purchased from BBB Co.

COGS = $Answer

2. Drago Company has a fiscal year end on December 31. The company has only one product in inventory, and all units of that product are identical (homogenous). The opening balance unit price is $12 per unit. Complete the following schedule to calculate the value of ending inventory using the weighted-average cost method under the perpetual inventory system. Then calculate the cost of goods sold for the year 2022.

Do not enter dollar signs or commas in the input boxes.

Round all answers to 2 decimal places.

| Date | Purchases | Sales | Balance | |||

| Quantity | Cost | Quantity | Cost | Quantity | Value | |

| Jan 26 | 100 | $Answer | ||||

| Feb 18 | 14 | $13.00 | 114 | $Answer | ||

| Mar 6 | 32 | $15.00 | 146 | $Answer | ||

| Apr 27 | 15 | $12.75 | 131 | $Answer | ||

| Jul 21 | 17 | $17.00 | 148 | $Answer | ||

| Sep 3 | 34 | $13.24 | 114 | $Answer | ||

| Nov 16 | 11 | $13.24 | 103 | $Answer | ||

Required

Calculate the cost of goods sold.

Cost of Goods Sold = $Answer

3. An inventory record card for item M-405 shows the following details in 2022.

| Date | Purchases | Sales | Balance | ||||

| Quantity | Cost/Unit | Quantity | Cost/Unit | Quantity | Cost/Unit | ||

| Mar 1 | 55 | $68 | |||||

| Mar 5 | 37 | $68 | 18 | $68 | |||

| Mar 9 | 18 | $68 | |||||

| 119 | $70 | 119 | $70 | ||||

| Mar 18 | 18 | $68 | |||||

| 51 | $70 | 68 | $70 | ||||

| Mar 24 | 68 | $70 | |||||

| 44 | $73 | 44 | $73 | ||||

| Mar 29 | 68 | $70 | |||||

| 27 | $73 | 17 | $73 | ||||

| Mar 31 | 17 | $73 | |||||

| 42 | $77 | 42 | $77 | ||||

Required

The company uses the FIFO cost method for inventory valuation under the perpetual inventory system. Calculate the cost of goods sold for the month, and the value of ending inventory at the end of March.

Do not enter dollar signs or commas in the input boxes.

Cost of Goods Sold = $Answer

Ending Inventory = $Answer

4. GB, a bookseller, had the following transactions during the month of March 2022 and uses the perpetual inventory system.

| Date | Transaction | Purchases | Sales | Balance | |||

| Quantity | Cost | Quantity | Cost | Quantity | Cost | ||

| Mar 1 | 0 | $0 | |||||

| Mar 1 | Bought 25 novels at $32 each. | 25 | $32 | 25 | $32 | ||

| Mar 4 | Bought 25 bags at $43 each. | 25 | $32 | ||||

| 25 | $43 | 25 | $43 | ||||

| Mar 9 | Sold 7 bags. | 25 | $32 | ||||

| 7 | $43 | 18 | $43 | ||||

| Mar 17 | Bought 24 pencil cases at $5 each. | 25 | $32 | ||||

| 18 | $43 | ||||||

| 24 | $5 | 24 | $5 | ||||

| Mar 22 | Sold 6 bags. | 25 | $32 | ||||

| 6 | $43 | 12 | $43 | ||||

| 24 | $5 | ||||||

| Mar 25 | Sold 9 pencil cases | 25 | $32 | ||||

| 12 | $43 | ||||||

| 9 | $5 | 15 | $5 | ||||

Required

The company uses the specific identification cost method for inventory valuation. Calculate the cost of goods sold, and the value of ending inventory for March.

Do not enter dollar signs or commas in the input boxes.

Cost of Goods Sold = $Answer

Ending Inventory = $Answer

5. A company reported ending inventory of $81,000 in Year 1. It was discovered in Year 2 that the correct value of the ending inventory was $109,000 for Year 1, and a correction was made. Complete the following table based on this information. Assume the company uses the perpetual inventory system.

Do not enter dollar signs or commas in the input boxes.

Enter a negative sign as appropriate for the Profit(Loss) line item.

| Item | Reported | Correct Amount |

| Inventory | $81,000 | $Answer |

| Current Assets | $187,000 | $Answer |

| Total Assets | $590,000 | $Answer |

| Owner's Equity, Year 1 | $192,000 | $Answer |

| Sales | $1,020,000 | $Answer |

| Cost of Goods Sold | $510,000 | $Answer |

| Profit (Loss) for Year 1 | $13,000 | $Answer |

6. A company has three types of products: gadgets, widgets, and gizmos. The cost and market price of each type is listed below. Complete the table by applying the lower of cost and net realizable value (LCNRV).

Do not enter dollar signs or commas in the input boxes.

| LCNRV Applied to | ||||||

| Description | Category | Cost | NRV | Individual | Category | Total |

| Gadget Type 1 | Gadgets | $950 | $1,080 | $Answer | ||

| Gadget Type 2 | Gadgets | $5,100 | $5,400 | $Answer | ||

| Total Gadgets | $Answer | $Answer | $Answer | |||

| Widget A | Widgets | $110 | $110 | $Answer | ||

| Widget B | Widgets | $230 | $60 | $Answer | ||

| Total Widgets | $Answer | $Answer | $Answer | |||

| Gizmo 1 | Gizmos | $2,320 | $2,110 | $Answer | ||

| Gizmo 2 | Gizmos | $2,000 | $2,210 | $Answer | ||

| Total Gizmos | $Answer | $Answer | $Answer | |||

| Total | $Answer | $Answer | $Answer | $Answer | $Answer | |

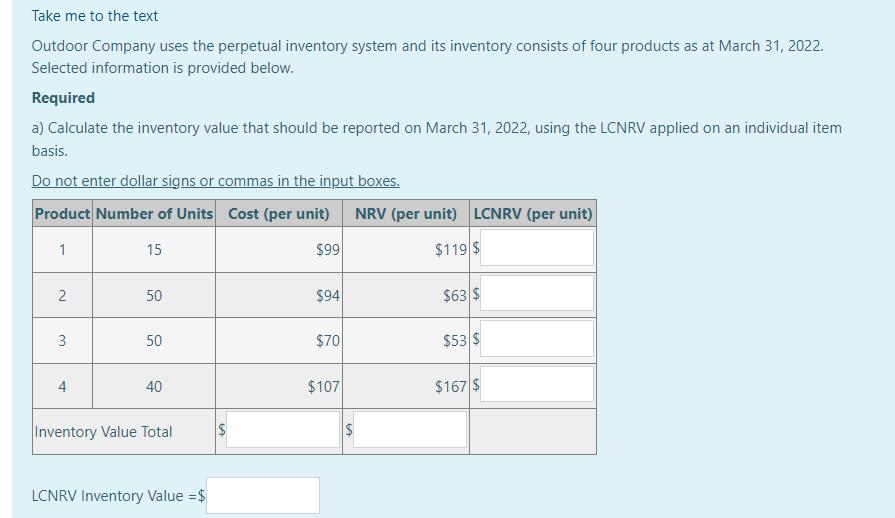

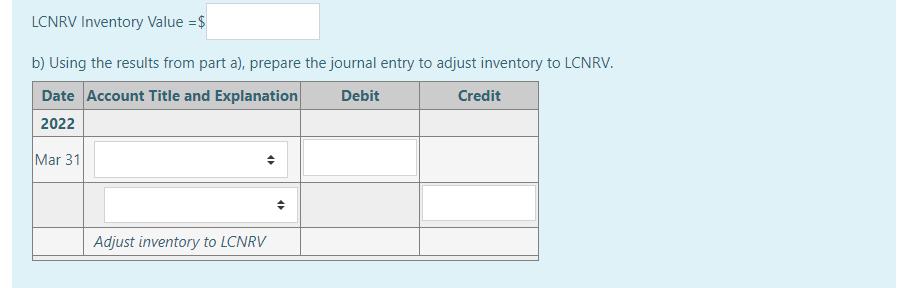

Take me to the text Outdoor Company uses the perpetual inventory system and its inventory consists of four products as at March 31, 2022. Selected information is provided below. Required a) Calculate the inventory value that should be reported on March 31, 2022, using the LCNRV applied on an individual item basis. Do not enter dollar signs or commas in the input boxes. Product Number of Units Cost (per unit) NRV (per unit) LCNRV (per unit) 1 15 $99 $119 $ 2 3 4 50 50 40 Inventory Value Total LCNRV Inventory Value = $ LA $ $94 $70 $107 GA $ $63 $ $53 $ $167 $

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

1 a Weightedaverage Inventory Schedule Purchases Sales Balance Transaction Description Unit Cost Quantity Amount Quantity Amount Quantity Amount Opening Balance 0 0 May05 Purchase from AAA Co 12 400 4... View full answer

Get step-by-step solutions from verified subject matter experts