Mountain Nursery Company grows a variety of plants and sells them to local nurseries. Raw materials consist

Question:

You will be recording the following transactions, which summarize the activities that occurred during the year ended December 31, 2016:

1. Raw materials were purchased for $30,000 on account.

2. Raw materials totaling $41,000 were placed in production, $5,000 for indirect materials and $36,000 for direct materials.

3. The raw materials purchased in transaction 1 were paid for.

4. A total cost of $140,000 for 9,000 hours of direct labor, shown on the timesheets, was recorded as wages payable.

5. Production supervisors and other indirect labor working in the nursery were owed $134,000, recorded as wages payable.

6. Wages owed totaling $180,000 were paid. (These wages were previously recorded correctly as wages payable.)

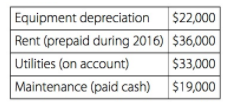

7. The costs listed in the following related to the nursery were incurred during the period.

8. Manufacturing overhead was applied at a rate of $30 per direct labor hour.

9. Miscellaneous selling costs totaling $63,000 were paid. These costs were recorded in an account called selling expenses.

10. Miscellaneous general and administrative costs totaling $18,000 were paid. These costs were recorded in an account called G&A expenses.

11. Goods costing $478,000 (per the job cost sheets) were completed and transferred out of work-in- process inventory.

12. Goods were sold on account for $780,000.

13. The goods sold in transaction 12 had a cost of $415,000 (per the job cost sheets).

14. Payments totaling $380,000 from credit customers related to transaction 12 were received.

Required:

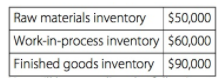

a. Prepare T-accounts for raw materials inventory, work-in-process inventory, finished goods inventory, manufacturing overhead, and cost of goods sold. Enter the beginning balances for the inventory accounts. (Manufacturing overhead and cost of goods sold are temporary accounts and thus do not have a beginning balance.)

b. Prepare a journal entry for each transaction from 1 through 14 in a format like the one in Figure 2.7, and where appropriate, post each entry to the T-accounts set up in requirement a. Note that these entries reflect the flow of costs through the inventory and cost of goods sold accounts for the year, so you are only posting the dollar amounts related to the T-accounts set up in requirement a. Label each entry in the T-accounts by transaction number, include a short description (e.g., direct materials and manufacturing overhead applied), and total each T-account.

c. Based on the balance in the manufacturing overhead account prepared in requirement b, prepare a journal entry to close the manufacturing overhead account to cost of goods sold.

d. Prepare an income statement for the year ended December 31, 2016. Remember to adjust cost of goods sold for any underapplied or overapplied overhead from requirement c.

e. Why is cost of goods sold adjusted downward on the income statement?

Step by Step Answer: