Question: 1 A firm should never accept a project if its acceptance would lead to an increase in the firm's cost of capital (its WACC). a.

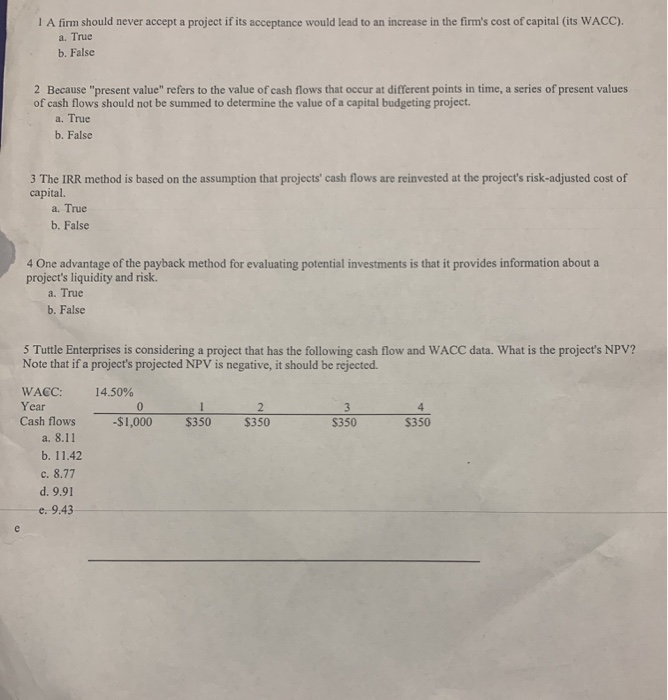

1 A firm should never accept a project if its acceptance would lead to an increase in the firm's cost of capital (its WACC). a. True b. False 2 Because "present value" refers to the value of cash flows that occur at different points in time, a series of present values of cash flows should not be summed to determine the value of a capital budgeting project. a. True b. False 3 The IRR method is based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital. a. True b. False 4 One advantage of the payback method for evaluating potential investments is that it provides information about a project's liquidity and risk. a. True b. False 5 Tuttle Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's projected NPV is negative, it should be rejected. 14.50% -$1,000 $350 $350 $350 $350 WACC: Year Cash flows a. 8.11 b. 11.42 c. 8.77 d. 9.91 e. 9.43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts