Question: immediate help needed Question 20 A firm should never accept a project if its acceptance would lead to an increase in the firm's cost of

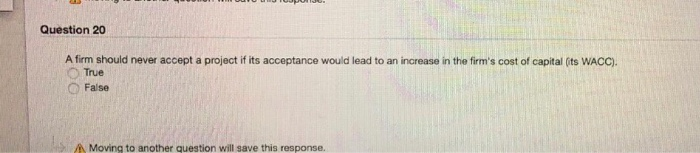

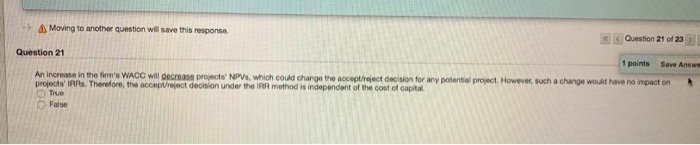

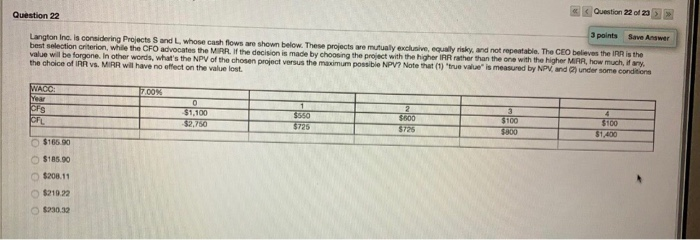

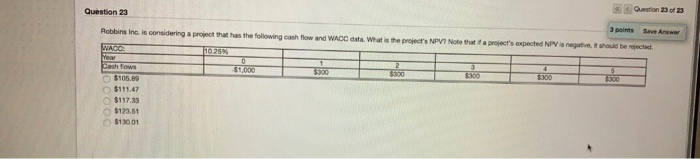

Question 20 A firm should never accept a project if its acceptance would lead to an increase in the firm's cost of capital (its WACC). True False Moving to another question will save this response. A Moving to another question will save this response. Question 21 of 23 Question 21 1 points Save Answe An increase in the firm's WACC will gecrease projects' NPVS, which could change the accept/reject decision for any potential project. However, such a change would have no inmpact on projects' IRRs. Therefore, the accept/reject decision under the IRR method is independent of the cost of capital True False Question 22 of 23 Question 22 3 points Save Answer Langton Inc. is considering Projects S and L whose cash flows are shown below. These projects are mutualy exclunive, equaly risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR, If the decision is made by choosing the proiect with the higher IRR rather than the one with the higher MIRA, how much, if any. value will be forgone. In other words, what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) true value" is measured by NPV, and (2) under some conditions the choice of IRR ys. MIRR will have no effect on the value lost WACC Year 7.00% 1 2 S600 C $1,100 $550 $100 $100 CFL $2.750 $725 $725 $800 $1,400 $166.90 O $185.90 $208.11 $219.22 O $230.32 Question 23 of 23 Question 23 3 points Robbins Inc. is considering a project that has the following cash flow and WACC data, What is the project's NPVn Note that if a project's expected NPV is negative, it should be rejected Save Answer WACC 10.25% Year Cash fows $1.000 $300 $300 $300 O$105.890 O $111.47 S300 $300 $117.33 O $123.51 $130.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts