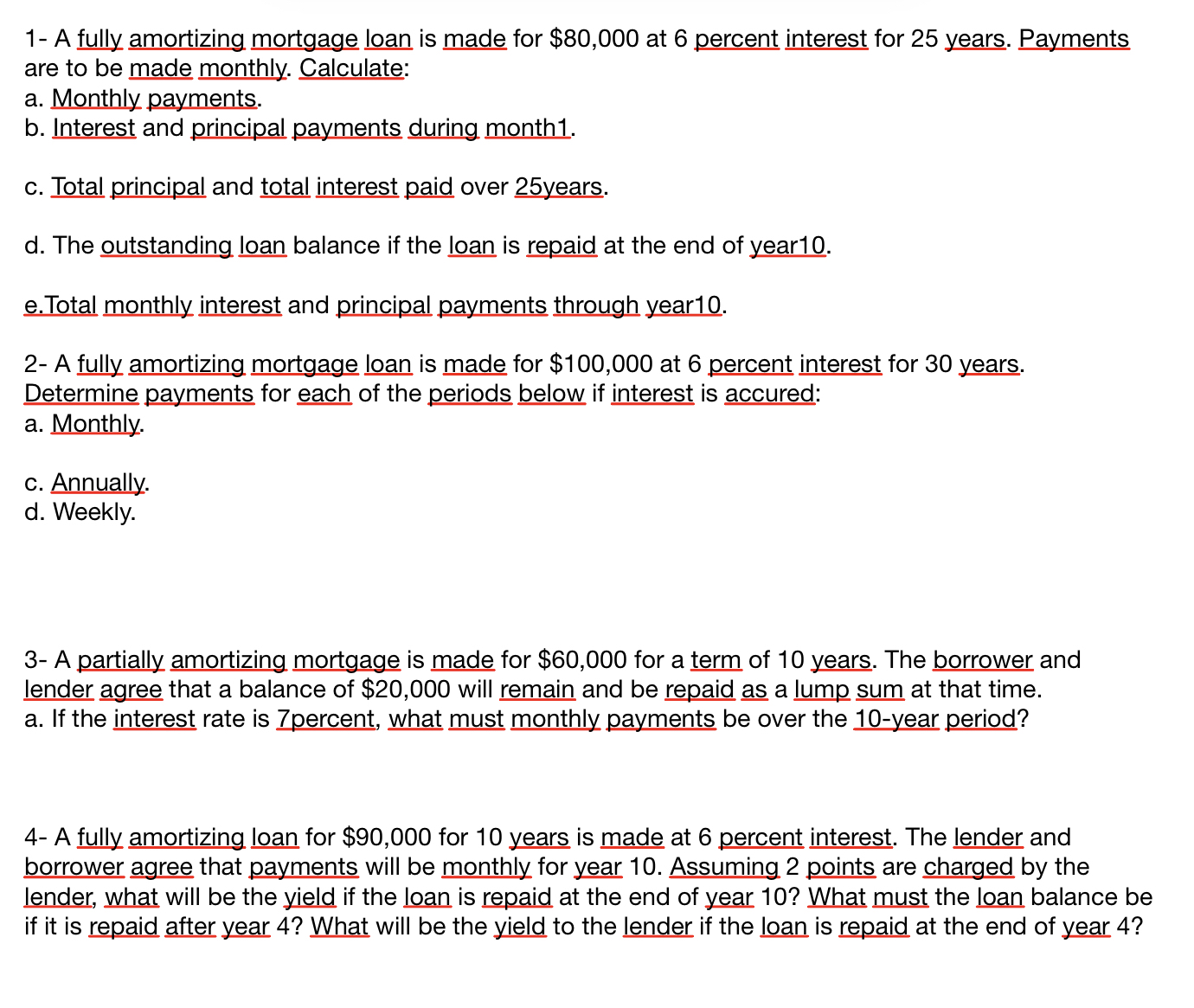

Question: 1 - A fully amortizing mortgage loan is made for $ 8 0 , 0 0 0 at 6 percent interest for 2 5 years.

A fully amortizing mortgage loan is made for $ at percent interest for years. Payments are to be made monthly. Calculate:

a Monthly payments.

b Interest and principal payments during month

c Total principal and total interest paid over years.

d The outstanding loan balance if the loan is repaid at the end of year

eTotal monthly interest and principal payments through year

A fully amortizing mortgage loan is made for $ at percent interest for years. Determine payments for each of the periods below if interest is accured:

a Monthly.

c Annually.

d Weekly.

A partially amortizing mortgage is made for $ for a term of years. The borrower and lender agree that a balance of $ will remain and be repaid as a lump sum at that time.

a If the interest rate is percent, what must monthly payments be over the year period?

A fully amortizing loan for $ for years is made at percent interest. The lender and borrower agree that payments will be monthly for year Assuming points are charged by the lender, what will be the yield if the loan is repaid at the end of year What must the loan balance be if it is repaid after year What will be the yield to the lender if the loan is repaid at the end of year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock