Question: Problem 3 (2 points) A crushed stone operation having a projected life of 10 years is offered for sale. If annual net cash flows are

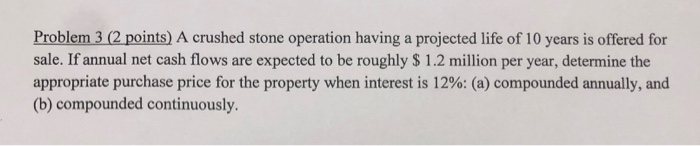

Problem 3 (2 points) A crushed stone operation having a projected life of 10 years is offered for sale. If annual net cash flows are expected to be roughly $ 1.2 million per year, determine the appropriate purchase price for the property when interest is 12%: (a) compounded annually, and (b) compounded continuously

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts