Question: 1. A long straddle combination includes buying a call option and a put option on the same underlying stock at the same exercise price and

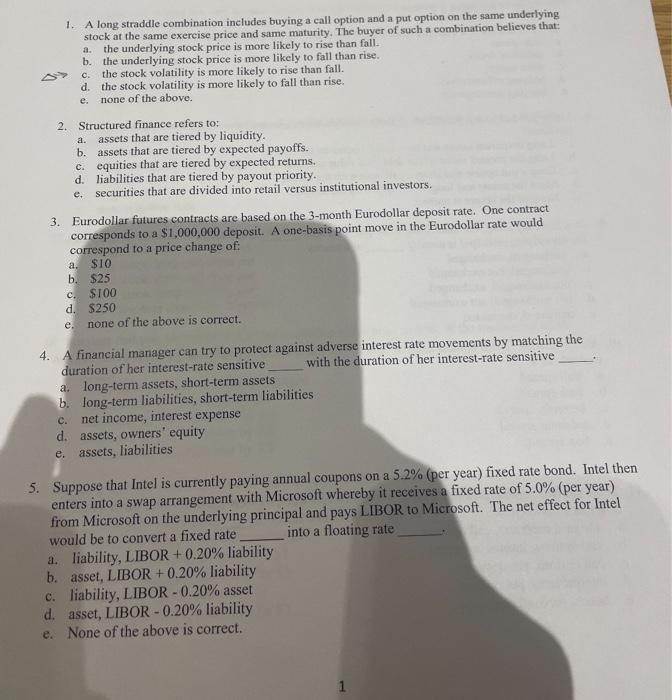

1. A long straddle combination includes buying a call option and a put option on the same underlying stock at the same exercise price and same maturity. The buyer of such a combination believes that: a. the underlying stock price is more likely to rise than fall. b. the underlying stock price is more likely to fall than rise. c. the stock volatility is more likely to rise than fall. d. the stock volatility is more likely to fall than rise. e. none of the above. 2. Structured finance refers to: a. assets that are tiered by liquidity. b. assets that are tiered by expected payoffs. c. equities that are tiered by expected returns. d. liabilities that are tiered by payout priority. e. securities that are divided into retail versus institutional investors. 3. Eurodollar futures contracts are based on the 3-month Eurodollar deposit rate. One contract corresponds to a $1,000,000 deposit. A one-basis point move in the Eurodollar rate would correspond to a price change of: a. $10 b. $25 c. $100 d. $250 e. none of the above is correct. 4. A financial manager can try to protect against adverse interest rate movements by matching the duration of her interest-rate sensitive with the duration of her interest-rate sensitive a. long-term assets, short-term assets b. long-term liabilities, short-term liabilities c. net income, interest expense d. assets, owners' equity e. assets, liabilities 5. Suppose that Intel is currently paying annual coupons on a 5.2% (per year) fixed rate bond. Intel then enters into a swap arrangement with Microsoft whereby it receives a fixed rate of 5.0% (per year) from Microsoft on the underlying principal and pays LIBOR to Microsoft. The net effect for Intel would be to convert a fixed rate into a floating rate a. liability, LIBOR+0.20% liability b. asset, LIBOR+0.20% liability c. liability, LIBOR 0.20% asset d. asset, LIBOR 0.20% liability e. None of the above is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts