Question: 1 A Question 1 (34 marks) - Company Valuation Ringo plc is planning to take over a smaller private limited company, Stellar Ltd, and needs

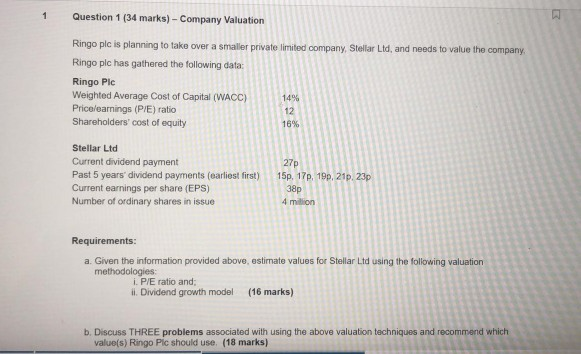

1 A Question 1 (34 marks) - Company Valuation Ringo plc is planning to take over a smaller private limited company, Stellar Ltd, and needs to value the company, Ringo plc has gathered the following data: Ringo Plc Weighted Average Cost of Capital (WACC) 14% Pricelearnings (P/E) ratio 12 Shareholders' cost of equity 16% Stellar Ltd Current dividend payment 27p Past 5 years dividend payments (earliest first) 15p, 17p. 190, 210 23p Current earnings per share (EPS) 38p Number of ordinary shares in issue 4 milion Requirements: a. Given the information provided above, estimate values for Stellar Ltd using the following valuation methodologies i. P/E ratio and ii. Dividend growth model (16 marks) b. Discuss THREE problems associated with using the above valuation techniques and recommend which value(s) Ringo Pic should use (18 marks) 1 A Question 1 (34 marks) - Company Valuation Ringo plc is planning to take over a smaller private limited company, Stellar Ltd, and needs to value the company, Ringo plc has gathered the following data: Ringo Plc Weighted Average Cost of Capital (WACC) 14% Pricelearnings (P/E) ratio 12 Shareholders' cost of equity 16% Stellar Ltd Current dividend payment 27p Past 5 years dividend payments (earliest first) 15p, 17p. 190, 210 23p Current earnings per share (EPS) 38p Number of ordinary shares in issue 4 milion Requirements: a. Given the information provided above, estimate values for Stellar Ltd using the following valuation methodologies i. P/E ratio and ii. Dividend growth model (16 marks) b. Discuss THREE problems associated with using the above valuation techniques and recommend which value(s) Ringo Pic should use (18 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts