Question: Question 9 (Mandatory) (18 points) An earthwork contractor is considering to purchase a new excavator which will cost $130,000 including tax and transportation expenses. Answer

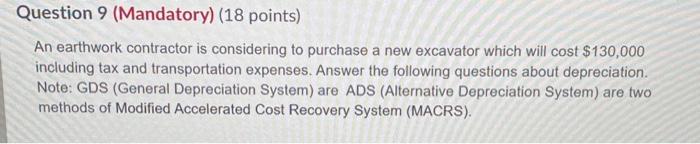

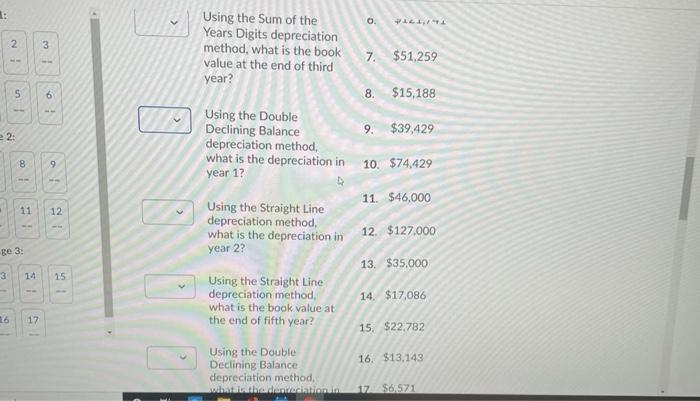

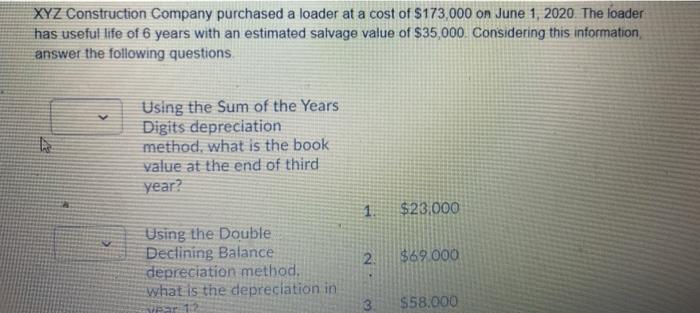

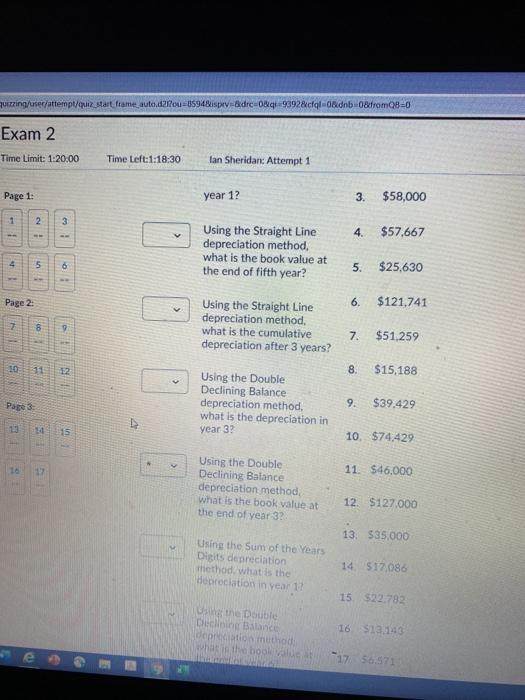

Question 9 (Mandatory) (18 points) An earthwork contractor is considering to purchase a new excavator which will cost $130,000 including tax and transportation expenses. Answer the following questions about depreciation. Note: GDS (General Depreciation System) are ADS (Alternative Depreciation System) are two methods of Modified Accelerated Cost Recovery System (MACRS). 0. 2 3 Using the Sum of the Years Digits depreciation method, what is the book value at the end of third year? 7. $51,259 5 6 8. $15,188 9. 2 . $39,429 Using the Double Declining Balance depreciation method, what is the depreciation in year 12 8 9 10. $74,429 11. $46,000 11 12 Using the Straight Line depreciation method, what is the depreciation in year 22 12. $127.000 se 3: 13. $35.000 3 15 Using the Straight Line depreciation method, what is the book value at the end of fifth year? 14. $17,086 16 17 15. $22.782 16. $13,143 Using the Double Declining Balance depreciation method subdodom 17 $6,571 XYZ Construction Company purchased a loader at a cost of $173,000 on June 1, 2020. The loader has useful life of 6 years with an estimated salvage value of $35,000. Considering this information answer the following questions Using the Sum of the Years Digits depreciation method, what is the book value at the end of third year? 1. $23,000 Using the Double Declining Balance depreciation method. what is the depreciation in 2 $69.000 var 3 S58.000 uitzing/user/attempt/quiz start frame_auto_d27c=1594&ispev-deco&q9928cqldnb OtromQ8=0 Exam 2 Time Limit: 1:20.00 Time Left:1:18:30 lan Sheridan: Attempt 1 Page 1: year 1? 3. $58,000 2 3 . 4. $57,667 Using the Straight Line depreciation method what is the book value at the end of fifth year? 5 o 5. $25,630 Page 2 6. $121,741 co 2 Using the Straight Line depreciation method what is the cumulative depreciation after 3 years? 7 $51,259 10 1 12 8. $15,188 W Page 3 Using the Double Declining Balance depreciation method, what is the depreciation in year 3? 9. $39.429 V 13 15 10. $74,429 11. $46,000 Using the Double Declining Balance depreciation method what is the book value at the end of year 32 12. $127.000 13. $35.000 Using the sum of the Years Digits depreciation method, what is the depreciation in year 17 14 $17.08 15 $22.782 the Double Declining Balance atton hothod Thabol 16 $13,140 *1756.571

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts