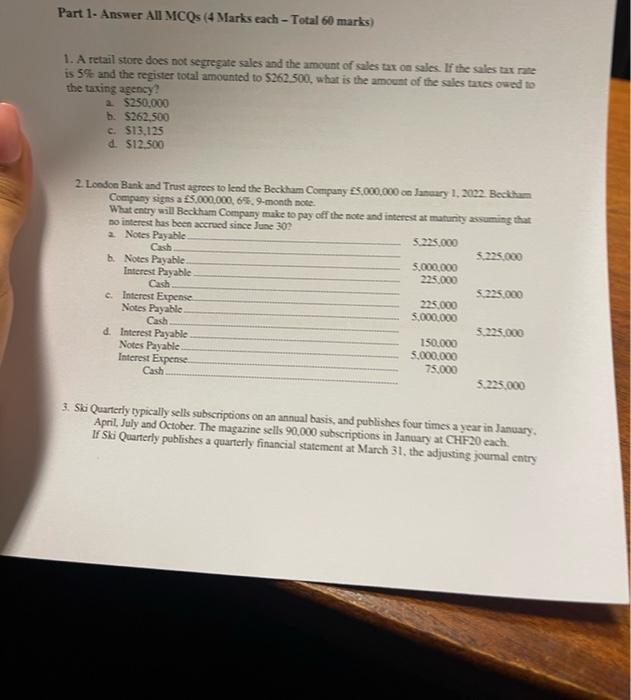

Question: 1. A retail store does not segregate sales and the amount of sales tax on sales. If the sales tax rate is 5% and the

1. A retail store does not segregate sales and the amount of sales tax on sales. If the sales tax rate is 5% and the register total amounted to $262.500, what is the amount of the soles taxes owed to the taxing agency? 2. 5250.000 b. $262,500 c. $13,125 d. 512.500 2. Loodon Bank and Trust agrecs to lend the Beckhan Company 5,000,000 on Jatary 1, 2092. Beckum Compury signs a 15,000,000,6%,9-month note. What entry will Beckham Compuny make to pay off the note and interest at maturity assuming that no interect has been accrued since June 30 ? 2. Notes Payable Cach. b. Notes Payable. Interest Pyyable c. Interest Expense Notes Payable. Cash d. Interest Payable Notes Payable Interest Expense 5,225,0005,000,000225,000225,0005,000,000150,0005,000,00075,0005,225,0005,225,0005,225,000 3. Sid Quarterly typically sells subscriptions on an annual basis, and publishes four times a year in January. April, July and October. The magazine sells 90,000 subscriptions in January at CHF20 each. If Ski Quanterly publishes a quarterly financial statement at March 31, the adjusting journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts