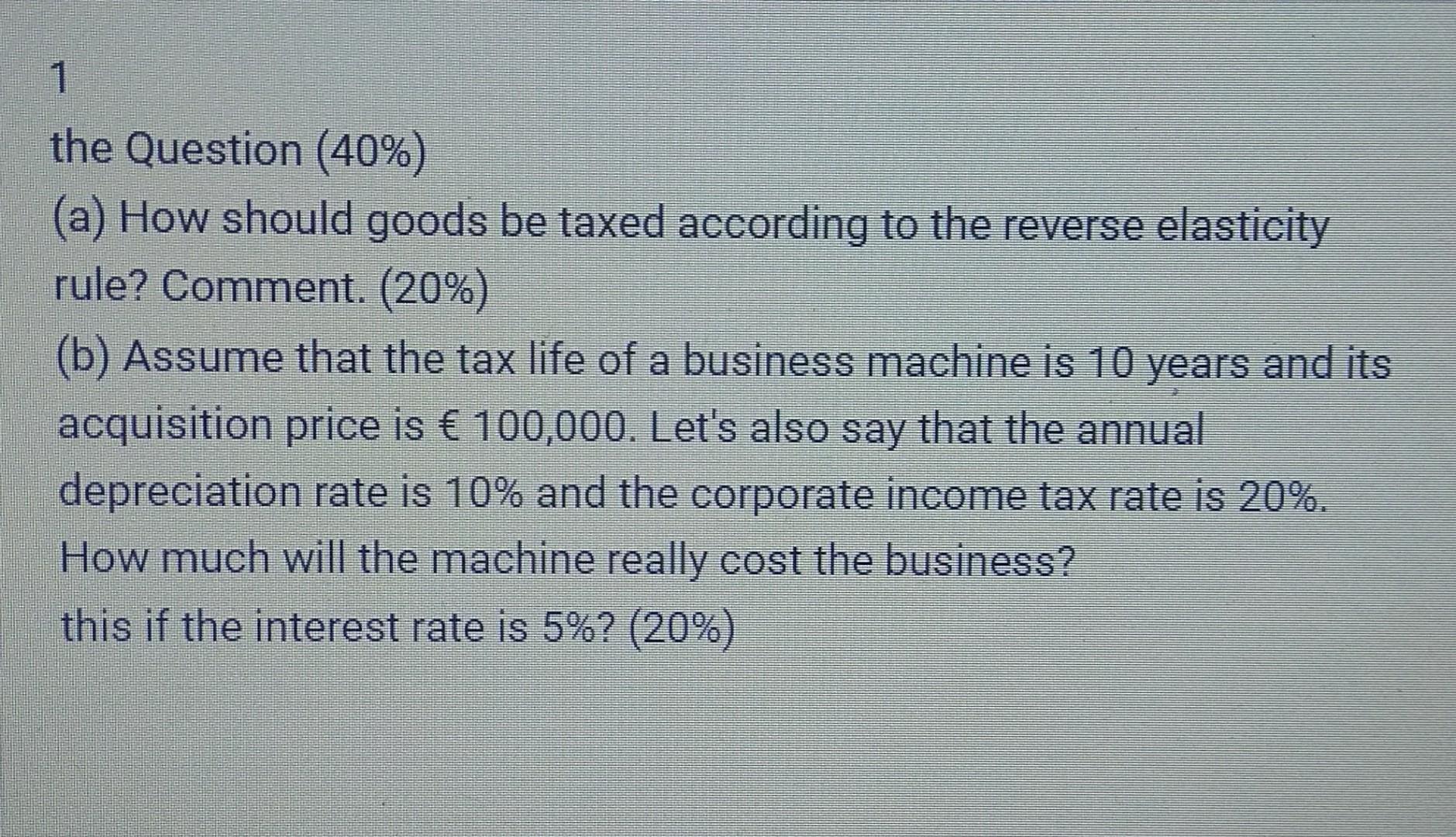

Question: 1 a the Question (40%) (a) How should goods be taxed according to the reverse elasticity rule? Comment. (20%) (b) Assume that the tax life

1 a the Question (40%) (a) How should goods be taxed according to the reverse elasticity rule? Comment. (20%) (b) Assume that the tax life of a business machine is 10 years and its acquisition price is 100,000. Let's also say that the annual depreciation rate is 10% and the corporate income tax rate is 20%. How much will the machine really cost the business? this if the interest rate is 5%? (20%) 1 a the Question (40%) (a) How should goods be taxed according to the reverse elasticity rule? Comment. (20%) (b) Assume that the tax life of a business machine is 10 years and its acquisition price is 100,000. Let's also say that the annual depreciation rate is 10% and the corporate income tax rate is 20%. How much will the machine really cost the business? this if the interest rate is 5%? (20%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts