Question: (1) A zero-coupon bond is a security that pays no interest, and is therefore boughtat a substantial discount from its face value. If the interst

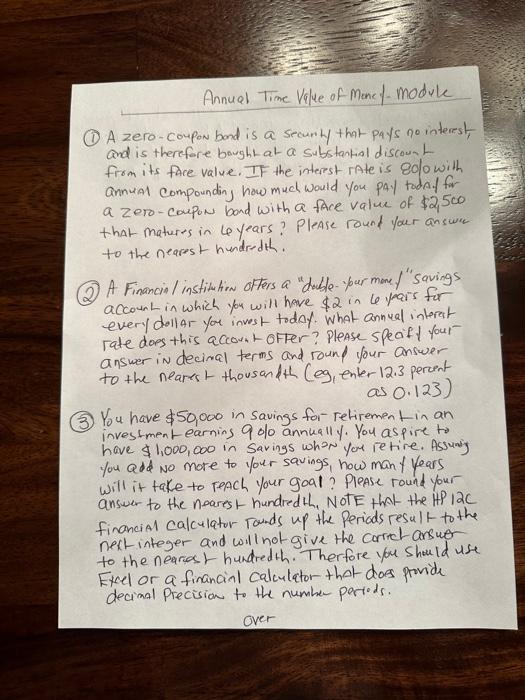

(1) A zero-coupon bond is a security that pays no interest, and is therefore boughtat a substantial discount from its face value. If the interst rate is 8010 with annual compounding how mucl would you pay todn. f for a zero-coupon bond with a fAce value of $2,500 that matures in 6 years? Please rount your answer to the nearest hundredith. (2) A Financin / instiution ofters a "duble- pour mone f" savings account in which you will have $2 in 6 years for every dollar you invest today. What annual interat rate does this account ofter? Please specift yout answer in decinal terms and round your answer to the nearest thousandth (eg, enter 12.3 perent as 0.123 ) (3) Yo u have $50,000 in savings for retirement in an investment earning 900 annuall %. You aspire to have $1,000,000 in savings whan you retire. Assunity you add no more to your savings, how man 1 years will it take to reach your goal? Please round your answer to the nearest hundred th, NoTE thet the IPP 12C financial calculator rounds up the periods result to the next integer and will not give the corret ansuer to the nearast hundred th. Therfore you should use Excel or a financinl calculator that does provide decinal precision to the number periods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts