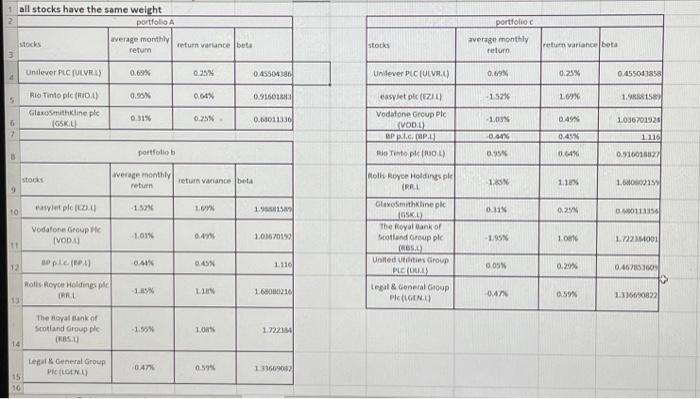

Question: 1 all stocks have the same weight 2 portfolio average monthly return portfolio averager monthly return return variance buta stocks return variance beta Unilever PLC

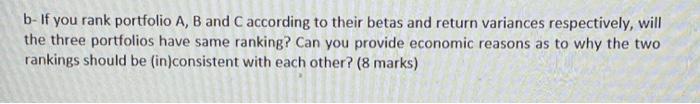

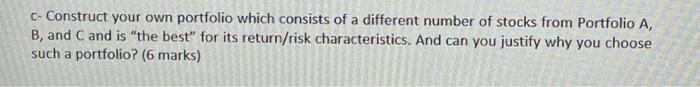

1 all stocks have the same weight 2 portfolio average monthly return portfolio averager monthly return return variance buta stocks return variance beta Unilever PLC (ULVEL 0.69% 0.25% 0.45501386 Un dever PLC (ULVRU) 0.69 0.25% 0.455013858 0.95% 0.66% 0.91601333 -15 169X 1.15 Rio Tinto plc (RO) GlaxoSmithKline ple 0.25% 0.00011330 0.49% -1.03% 1036701926 esset plc (ZILI Vodafone Group PIC VODU Ple, WAP | Rio Tinto plo) 6 2 -0.44 0.45% 1110 portfolio 0.95% 0.6 0.91001017 stocks were monthly return return variance beta 1SN 1 1.600015 10 awet plc 15% 1. Rolls Royce Holdings ple IRRI GlaxoSmithKlinec IGSKL The Royal Bank of Scotland Group 1915 0.31 0.25% 00011150 Vodafone Groupe IV0011 1,01% 0.4 1.01670193 1.95 10 1.722001 pl 00N 0.45 12 1110 0.05% 0.2 Rolls Royce Holdings ple IRL United Utilities Group PLC ULLI Legal & General Group PIEGEND 0.467151003 > 3660822 LIN 1.6800210 0.59% The Royal Bank of Scotland Group plc -1.95% LORS 172234 14 Lepa & General Group CLONA 0.47 0594 11366908 15 10 b- If you rank portfolio A, B and C according to their betas and return variances respectively, will the three portfolios have same ranking? Can you provide economic reasons as to why the two rankings should be (in)consistent with each other? (8 marks) C- Construct your own portfolio which consists of a different number of stocks from Portfolio A, B, and C and is "the best" for its return/risk characteristics. And can you justify why you choose such a portfolio? (6 marks) L M 0.5996 portfolio A portfolio avreage monthly return portfolio return variance portfolio beta portfolio C portfolio avreage monthly return -1.58% portfolio return variance 12.72% portfolio beta 3.420127334 4.03% 0.615352815 portfolio standard deviation portfolio standard deviation 0.16396 1.62% portfolio B portfolio avreage monthly return portfolio return variance -2.18% 16.95% , 2.664418437 portfolio beta portfolio Standard deviation 2.87% 1 all stocks have the same weight 2 portfolio average monthly return portfolio averager monthly return return variance buta stocks return variance beta Unilever PLC (ULVEL 0.69% 0.25% 0.45501386 Un dever PLC (ULVRU) 0.69 0.25% 0.455013858 0.95% 0.66% 0.91601333 -15 169X 1.15 Rio Tinto plc (RO) GlaxoSmithKline ple 0.25% 0.00011330 0.49% -1.03% 1036701926 esset plc (ZILI Vodafone Group PIC VODU Ple, WAP | Rio Tinto plo) 6 2 -0.44 0.45% 1110 portfolio 0.95% 0.6 0.91001017 stocks were monthly return return variance beta 1SN 1 1.600015 10 awet plc 15% 1. Rolls Royce Holdings ple IRRI GlaxoSmithKlinec IGSKL The Royal Bank of Scotland Group 1915 0.31 0.25% 00011150 Vodafone Groupe IV0011 1,01% 0.4 1.01670193 1.95 10 1.722001 pl 00N 0.45 12 1110 0.05% 0.2 Rolls Royce Holdings ple IRL United Utilities Group PLC ULLI Legal & General Group PIEGEND 0.467151003 > 3660822 LIN 1.6800210 0.59% The Royal Bank of Scotland Group plc -1.95% LORS 172234 14 Lepa & General Group CLONA 0.47 0594 11366908 15 10 b- If you rank portfolio A, B and C according to their betas and return variances respectively, will the three portfolios have same ranking? Can you provide economic reasons as to why the two rankings should be (in)consistent with each other? (8 marks) C- Construct your own portfolio which consists of a different number of stocks from Portfolio A, B, and C and is "the best" for its return/risk characteristics. And can you justify why you choose such a portfolio? (6 marks) L M 0.5996 portfolio A portfolio avreage monthly return portfolio return variance portfolio beta portfolio C portfolio avreage monthly return -1.58% portfolio return variance 12.72% portfolio beta 3.420127334 4.03% 0.615352815 portfolio standard deviation portfolio standard deviation 0.16396 1.62% portfolio B portfolio avreage monthly return portfolio return variance -2.18% 16.95% , 2.664418437 portfolio beta portfolio Standard deviation 2.87%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts