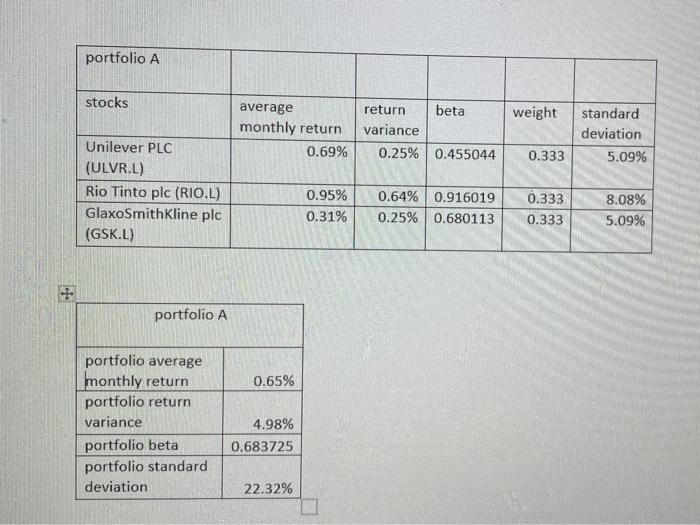

Question: portfolio A stocks weight average monthly return 0.69% return beta variance 0.25% 0.455044 standard deviation 5.09% 0.333 Unilever PLC (ULVR.L) Rio Tinto plc (RIO.L) GlaxoSmithKline

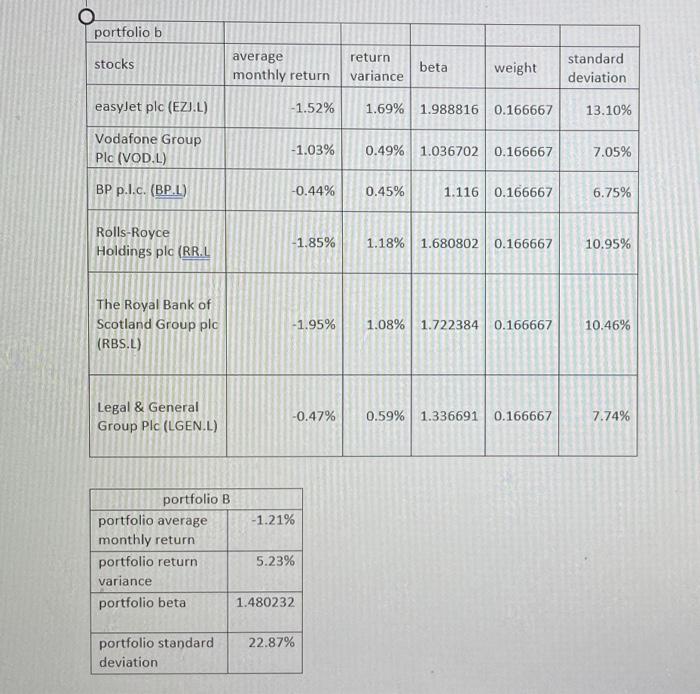

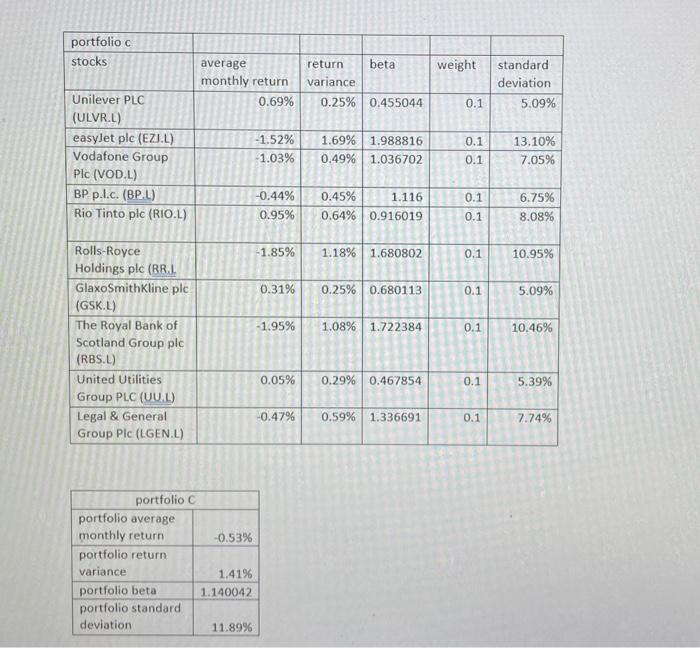

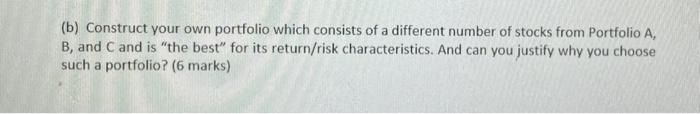

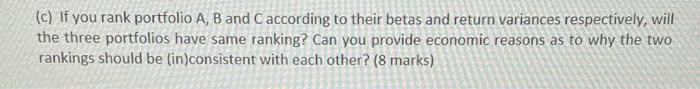

portfolio A stocks weight average monthly return 0.69% return beta variance 0.25% 0.455044 standard deviation 5.09% 0.333 Unilever PLC (ULVR.L) Rio Tinto plc (RIO.L) GlaxoSmithKline plc (GSK.L) 0.95% 0.31% 0.64% 0.916019 0.25% 0.680113 0.333 0.333 8.08% 5.09% portfolio A 0.65% portfolio average monthly return portfolio return variance portfolio beta portfolio standard deviation 4.98% 0.683725 22.32% portfolio b stocks average monthly return return variance beta weight standard deviation easyJet plc (EZI.L) -1.52% 1.69% 1.988816 0.166667 13.10% Vodafone Group Plc (VOD.L) -1.03% 0.49% 1.036702 0.166667 7.05% BP p.1.c. (BP.L) -0.44% 0.45% 1.116 0.166667 6.75% Rolls-Royce Holdings plc (RR.L -1.85% 1.18% 1.680802 0.166667 10.95% The Royal Bank of Scotland Group plc (RBS.L) -1.95% 1.08% 1.722384 0.166667 10.46% Legal & General Group Plc (LGEN.L) -0.47% 0.47% 0.59% 1.3366910.166667 7.74% portfolio B portfolio average -1.21% monthly return portfolio return 5.23% variance portfolio beta 1.480232 22.87% portfolio stand deviation portfolio c stocks beta average monthly return 0.69% return variance weight standard deviation 5.09% 0.25% 0.455044 0.1 Unilever PLC (ULVR.L) easyJet plc (EZI.L) Vodafone Group Plc (VOD.L) BP p.I.c. (BP.1) Rio Tinto plc (RIO.L) -1.52% -1.03% 1.69% 1.988816 0.49% 1.036702 0.1 0.1 13.10% 7.05% 0.1 6.75% -0.44% 0.95% 0.45% 1.116 0.64% 0.916019 0.1 8.08% -1.85% 1.18% 1.680802 0.1 10.95% 0.31% 0.25% 0.680113 0.1 5.09% -1.95% 1.08% 1.722384 0.1 10.46% Rolls-Royce Holdings plc (RRI GlaxoSmithKline plc (GSK.L) The Royal Bank of Scotland Group plc (RBS.L) United Utilities Group PLC (UU.L) Legal & General Group Plc (LGEN.L) 0.05% 0.29% 0.467854 0.1 5.39% 0.47% -0.47% 0.59% 1.336691 0.1 7.74% -0.53% portfolio portfolio average monthly return portfolio return variance portfolio beta portfolio standard deviation 1.4196 1.140042 11.8996 (b) Construct your own portfolio which consists of a different number of stocks from Portfolio A, B, and C and is "the best" for its return/risk characteristics. And can you justify why you choose such a portfolio? (6 marks) (c) If you rank portfolio A, B and C according to their betas and return variances respectively, will the three portfolios have same ranking? Can you provide economic reasons as to why the two rankings should be (in)consistent with each other? (8 marks) portfolio A stocks weight average monthly return 0.69% return beta variance 0.25% 0.455044 standard deviation 5.09% 0.333 Unilever PLC (ULVR.L) Rio Tinto plc (RIO.L) GlaxoSmithKline plc (GSK.L) 0.95% 0.31% 0.64% 0.916019 0.25% 0.680113 0.333 0.333 8.08% 5.09% portfolio A 0.65% portfolio average monthly return portfolio return variance portfolio beta portfolio standard deviation 4.98% 0.683725 22.32% portfolio b stocks average monthly return return variance beta weight standard deviation easyJet plc (EZI.L) -1.52% 1.69% 1.988816 0.166667 13.10% Vodafone Group Plc (VOD.L) -1.03% 0.49% 1.036702 0.166667 7.05% BP p.1.c. (BP.L) -0.44% 0.45% 1.116 0.166667 6.75% Rolls-Royce Holdings plc (RR.L -1.85% 1.18% 1.680802 0.166667 10.95% The Royal Bank of Scotland Group plc (RBS.L) -1.95% 1.08% 1.722384 0.166667 10.46% Legal & General Group Plc (LGEN.L) -0.47% 0.47% 0.59% 1.3366910.166667 7.74% portfolio B portfolio average -1.21% monthly return portfolio return 5.23% variance portfolio beta 1.480232 22.87% portfolio stand deviation portfolio c stocks beta average monthly return 0.69% return variance weight standard deviation 5.09% 0.25% 0.455044 0.1 Unilever PLC (ULVR.L) easyJet plc (EZI.L) Vodafone Group Plc (VOD.L) BP p.I.c. (BP.1) Rio Tinto plc (RIO.L) -1.52% -1.03% 1.69% 1.988816 0.49% 1.036702 0.1 0.1 13.10% 7.05% 0.1 6.75% -0.44% 0.95% 0.45% 1.116 0.64% 0.916019 0.1 8.08% -1.85% 1.18% 1.680802 0.1 10.95% 0.31% 0.25% 0.680113 0.1 5.09% -1.95% 1.08% 1.722384 0.1 10.46% Rolls-Royce Holdings plc (RRI GlaxoSmithKline plc (GSK.L) The Royal Bank of Scotland Group plc (RBS.L) United Utilities Group PLC (UU.L) Legal & General Group Plc (LGEN.L) 0.05% 0.29% 0.467854 0.1 5.39% 0.47% -0.47% 0.59% 1.336691 0.1 7.74% -0.53% portfolio portfolio average monthly return portfolio return variance portfolio beta portfolio standard deviation 1.4196 1.140042 11.8996 (b) Construct your own portfolio which consists of a different number of stocks from Portfolio A, B, and C and is "the best" for its return/risk characteristics. And can you justify why you choose such a portfolio? (6 marks) (c) If you rank portfolio A, B and C according to their betas and return variances respectively, will the three portfolios have same ranking? Can you provide economic reasons as to why the two rankings should be (in)consistent with each other? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts