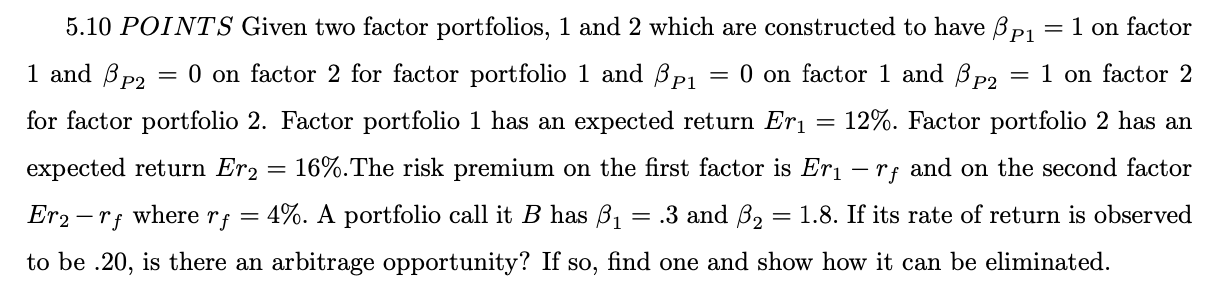

Question: 1 and BP2 5.10 POINTS Given two factor portfolios, 1 and 2 which are constructed to have pi =1 on factor = 0 on factor

1 and BP2 5.10 POINTS Given two factor portfolios, 1 and 2 which are constructed to have pi =1 on factor = 0 on factor 2 for factor portfolio 1 and Bpi = 0 on factor 1 and BP2 1 on factor 2 for factor portfolio 2. Factor portfolio 1 has an expected return Er 12%. Factor portfolio 2 has an expected return Er2 16%. The risk premium on the first factor is Er - rf and on the second factor -rf where rf 4%. A portfolio call it B has B1 .3 and B2 = 1.8. If its rate of return is observed to be .20, is there an arbitrage opportunity? If so, find one and show how it can be eliminated. Er2 = 1 and BP2 5.10 POINTS Given two factor portfolios, 1 and 2 which are constructed to have pi =1 on factor = 0 on factor 2 for factor portfolio 1 and Bpi = 0 on factor 1 and BP2 1 on factor 2 for factor portfolio 2. Factor portfolio 1 has an expected return Er 12%. Factor portfolio 2 has an expected return Er2 16%. The risk premium on the first factor is Er - rf and on the second factor -rf where rf 4%. A portfolio call it B has B1 .3 and B2 = 1.8. If its rate of return is observed to be .20, is there an arbitrage opportunity? If so, find one and show how it can be eliminated. Er2 =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts