Question: Problem #2. (20 points) Suppose the two factor portfolios, here called portfolios 1 and 2, have expected returns E (11)= 12% and E ( 12

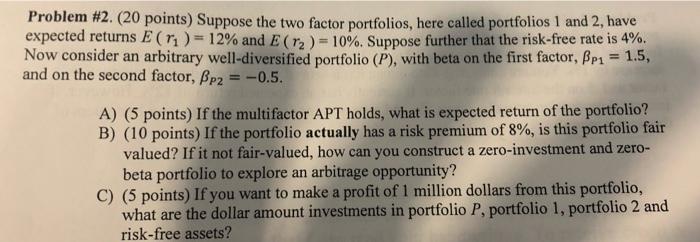

Problem #2. (20 points) Suppose the two factor portfolios, here called portfolios 1 and 2, have expected returns E (11)= 12% and E ( 12 ) = 10%. Suppose further that the risk-free rate is 4%. Now consider an arbitrary well-diversified portfolio (P), with beta on the first factor, Bp1 = 1.5, and on the second factor, Bp2 = -0.5. A) (5 points) If the multifactor APT holds, what is expected return of the portfolio? B) (10 points) If the portfolio actually has a risk premium of 8%, is this portfolio fair valued? If it not fair-valued, how can you construct a zero-investment and zero- beta portfolio to explore an arbitrage opportunity? C) (5 points) If you want to make a profit of 1 million dollars from this portfolio, what are the dollar amount investments in portfolio P, portfolio 1, portfolio 2 and risk-free assets? Problem #2. (20 points) Suppose the two factor portfolios, here called portfolios 1 and 2, have expected returns E (11)= 12% and E ( 12 ) = 10%. Suppose further that the risk-free rate is 4%. Now consider an arbitrary well-diversified portfolio (P), with beta on the first factor, Bp1 = 1.5, and on the second factor, Bp2 = -0.5. A) (5 points) If the multifactor APT holds, what is expected return of the portfolio? B) (10 points) If the portfolio actually has a risk premium of 8%, is this portfolio fair valued? If it not fair-valued, how can you construct a zero-investment and zero- beta portfolio to explore an arbitrage opportunity? C) (5 points) If you want to make a profit of 1 million dollars from this portfolio, what are the dollar amount investments in portfolio P, portfolio 1, portfolio 2 and risk-free assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts