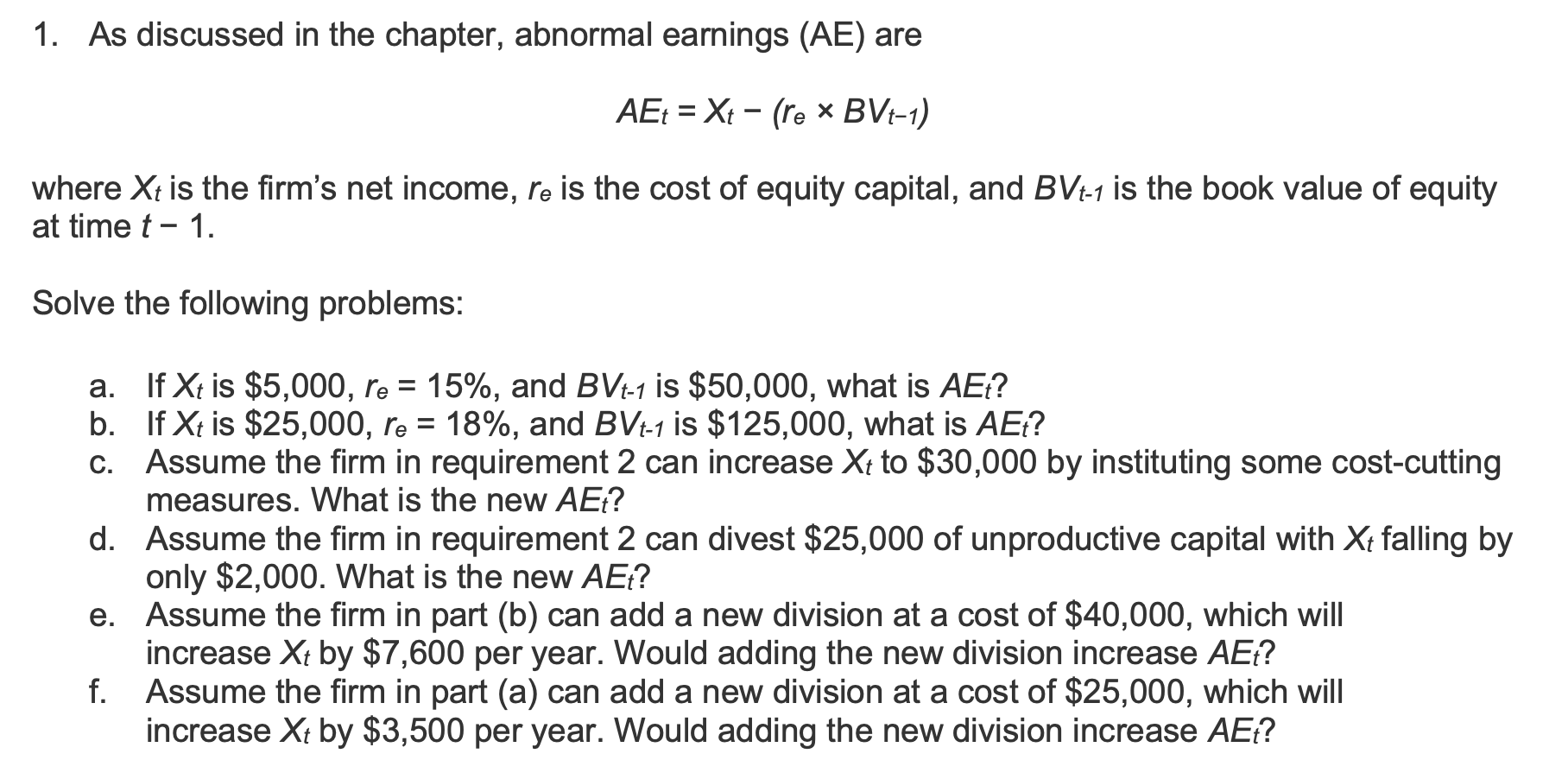

Question: 1. As discussed in the chapter, abnormal earnings (AE) are AEt = Xt (re * BVt-1) - where Xt is the firm's net income, re

1. As discussed in the chapter, abnormal earnings (AE) are AEt = Xt (re * BVt-1) - where Xt is the firm's net income, re is the cost of equity capital, and BVt-1 is the book value of equity at time t - 1. Solve the following problems: 9 a. If Xt is $5,000, re = 15%, and BVt-1 is $50,000, what is AE{? b. If Xt is $25,000, re = 18%, and BVt-1 is $125,000, what is AEt? c. Assume the firm in requirement 2 can increase Xt to $30,000 by instituting some cost-cutting measures. What is the new AE{? d. Assume the firm in requirement 2 can divest $25,000 of unproductive capital with Xt falling by only $2,000. What is the new AE{? e. Assume the firm in part (b) can add a new division at a cost of $40,000, which will increase Xt by $7,600 per year. Would adding the new division increase AE{? f. Assume the firm in part (a) can add a new division at a cost of $25,000, which will increase Xt by $3,500 per year. Would adding the new division increase AE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts