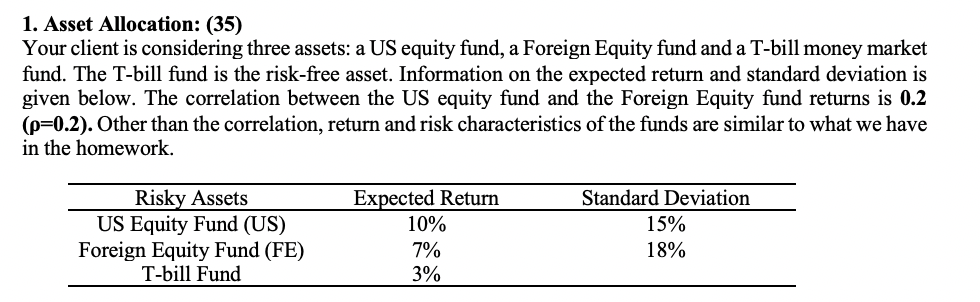

Question: 1. Asset Allocation: (35) Your client is considering three assets: a US equity fund, a Foreign Equity fund and a T-bill money market fund. The

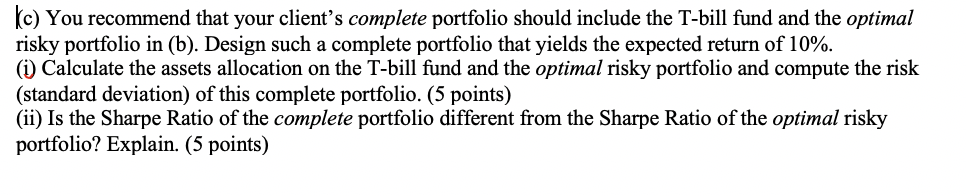

1. Asset Allocation: (35) Your client is considering three assets: a US equity fund, a Foreign Equity fund and a T-bill money market fund. The T-bill fund is the risk-free asset. Information on the expected return and standard deviation is given below. The correlation between the US equity fund and the Foreign Equity fund returns is 0.2 (p=0.2). Other than the correlation, return and risk characteristics of the funds are similar to what we have in the homework. Risky Assets US Equity Fund (US) Foreign Equity Fund (FE) T-bill Fund Expected Return 10% 7% 3% Standard Deviation 15% 18% Kc) You recommend that your client's complete portfolio should include the T-bill fund and the optimal risky portfolio in (b). Design such a complete portfolio that yields the expected return of 10%. (i) Calculate the assets allocation on the T-bill fund and the optimal risky portfolio and compute the risk (standard deviation) of this complete portfolio. (5 points) (ii) Is the Sharpe Ratio of the complete portfolio different from the Sharpe Ratio of the optimal risky portfolio? Explain. (5 points) 1. Asset Allocation: (35) Your client is considering three assets: a US equity fund, a Foreign Equity fund and a T-bill money market fund. The T-bill fund is the risk-free asset. Information on the expected return and standard deviation is given below. The correlation between the US equity fund and the Foreign Equity fund returns is 0.2 (p=0.2). Other than the correlation, return and risk characteristics of the funds are similar to what we have in the homework. Risky Assets US Equity Fund (US) Foreign Equity Fund (FE) T-bill Fund Expected Return 10% 7% 3% Standard Deviation 15% 18% Kc) You recommend that your client's complete portfolio should include the T-bill fund and the optimal risky portfolio in (b). Design such a complete portfolio that yields the expected return of 10%. (i) Calculate the assets allocation on the T-bill fund and the optimal risky portfolio and compute the risk (standard deviation) of this complete portfolio. (5 points) (ii) Is the Sharpe Ratio of the complete portfolio different from the Sharpe Ratio of the optimal risky portfolio? Explain. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts