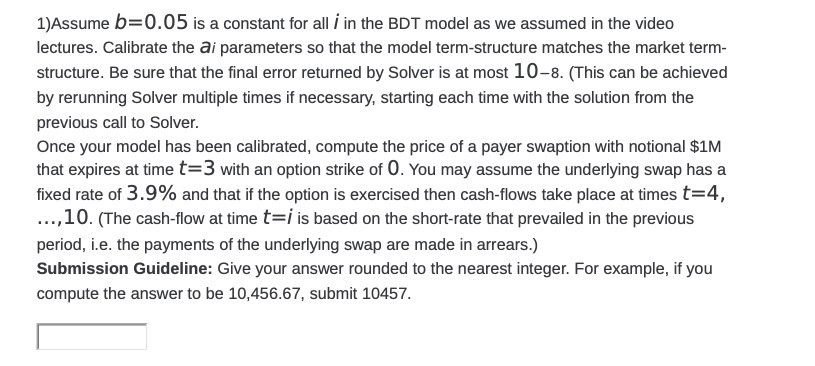

Question: 1 ) Assume b = 0 05 is a constant for all i in the BDT model as we assumed in the video lectures .

1 ) Assume b = 0 05 is a constant for all i in the BDT model as we assumed in the video lectures . Calibrate the ai parameters so that the model term - structure matches the market term Structure , Be sure that the final error returned by Solver is at most 10 - 8 . ( This can be achieved by rerunning Solver multiple times if necessary , starting each time with the solution from the previous call to Solve Once your model has been calibrated compute the price of a payer swaption with national SIM that expires at time = 3 with an option strike of O . You may assume the underlying swap has a fixed rate of 3 9/ and that if the option is exercised then cash - flows take place at times t = 4 10 . ( The cash flow at time t - is based on the short - rate that prevailed in the previous period , i . e . the payments of the underlying swap are made in arrears . ) Submission Guideline : Give your answer rounded to the nearest integer For example , if you compute the answer to be 10 456.67 , submit 10457

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts