Question: 1. Assume the required return (R) is 10% . using R, dividend information , and growth rate (g) compute the stock prices for this companies

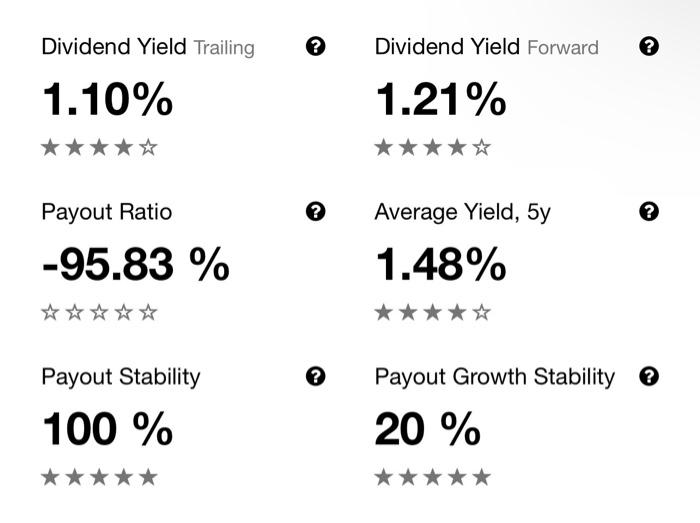

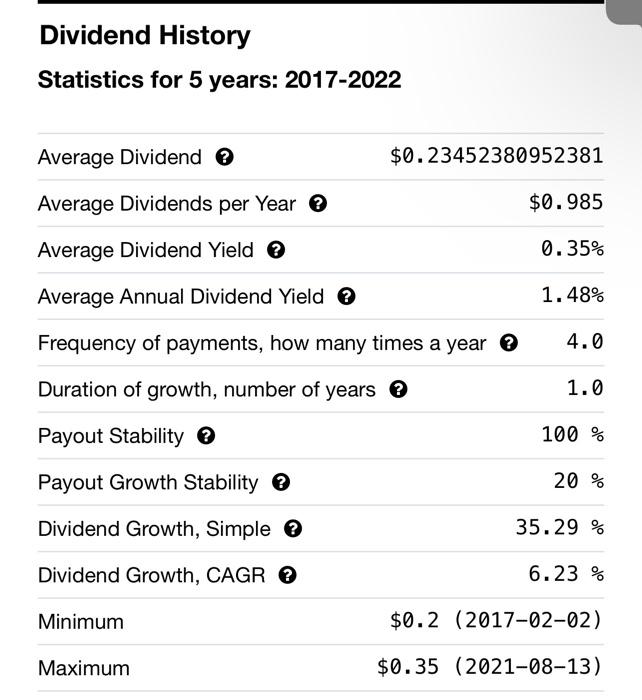

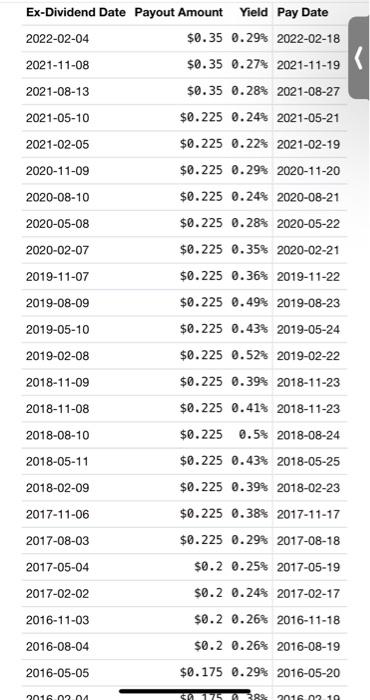

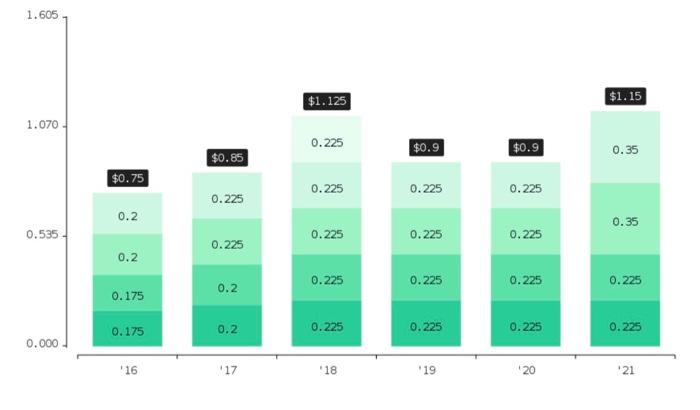

Dividend Yield Trailing Dividend Yield Forward 1.10% 1.21% ***** ? Payout Ratio -95.83 % Average Yield, 5y 1.48% ***** Payout Stability 100 % Payout Growth Stability 20 % Dividend History Statistics for 5 years: 2017-2022 Average Dividend $0.23452380952381 Average Dividends per Year $0.985 Average Dividend Yield 0.35% Average Annual Dividend Yield 1.48% Frequency of payments, how many times a year 4.0 Duration of growth, number of years 1.0 Payout Stability 100 % Payout Growth Stability 20 % Dividend Growth, Simple 35.29 % Dividend Growth, CAGR 6.23% Minimum $0.2 (2017-02-02) Maximum $0.35 (2021-08-13) Ex-Dividend Date Payout Amount Yield Pay Date 2022-02-04 $0.35 0.29% 2022-02-18 2021-11-08 $0.35 0.27% 2021-11-19 2021-08-13 $0.35 0.28% 2021-08-27 2021-05-10 $0.225 0.24% 2021-05-21 2021-02-05 $0.225 0.22% 2021-02-19 2020-11-09 $0.225 0.29% 2020-11-20 2020-08-10 $0.225 0.24% 2020-08-21 2020-05-08 $0.225 0.28% 2020-05-22 2020-02-07 $0.225 0.35% 2020-02-21 2019-11-07 $0.225 0.36% 2019-11-22 2019-08-09 $0.225 0.49% 2019-08-23 2019-05-10 $0.225 0.43% 2019-05-24 2019-02-08 $0.225 0.52% 2019-02-22 2018-11-09 $0.225 0.39% 2018-11-23 2018-11-08 $0.225 0.41% 2018-11-23 2018-08-10 $0.225 0.5% 2018-08-24 2018-05-11 $0.225 0.43% 2018-05-25 2018-02-09 $0.225 0.39% 2018-02-23 2017-11-06 $0.225 0.38% 2017-11-17 2017-08-03 $0.225 0.29% 2017-08-18 2017-05-04 $0.2 0.25% 2017-05-19 2017-02-02 $0.2 0.24% 2017-02-17 2016-11-03 $0.2 0.26% 2016-11-18 2016-08-04 $0.2 0.26% 2016-08-19 $0.175 0.29% 2016-05-20 2016-05-05 2016.02.04 STA 1775 38 2016.07 19 1.605 $1.125 $1.15 1.070 0.225 $0.9 $0.9 0.35 $0.85 $0.75 0.225 0.225 0.225 0.225 0.2 0.35 0.535 0.225 0.225 0.225 0.225 0.2 0.225 0.225 0.2 0.225 0.175 0.225 0.175 0.2 0.225 0.225 0.225 0.225 0.000 16 17 18 19 20 21 Dividend Yield Trailing Dividend Yield Forward 1.10% 1.21% ***** ? Payout Ratio -95.83 % Average Yield, 5y 1.48% ***** Payout Stability 100 % Payout Growth Stability 20 % Dividend History Statistics for 5 years: 2017-2022 Average Dividend $0.23452380952381 Average Dividends per Year $0.985 Average Dividend Yield 0.35% Average Annual Dividend Yield 1.48% Frequency of payments, how many times a year 4.0 Duration of growth, number of years 1.0 Payout Stability 100 % Payout Growth Stability 20 % Dividend Growth, Simple 35.29 % Dividend Growth, CAGR 6.23% Minimum $0.2 (2017-02-02) Maximum $0.35 (2021-08-13) Ex-Dividend Date Payout Amount Yield Pay Date 2022-02-04 $0.35 0.29% 2022-02-18 2021-11-08 $0.35 0.27% 2021-11-19 2021-08-13 $0.35 0.28% 2021-08-27 2021-05-10 $0.225 0.24% 2021-05-21 2021-02-05 $0.225 0.22% 2021-02-19 2020-11-09 $0.225 0.29% 2020-11-20 2020-08-10 $0.225 0.24% 2020-08-21 2020-05-08 $0.225 0.28% 2020-05-22 2020-02-07 $0.225 0.35% 2020-02-21 2019-11-07 $0.225 0.36% 2019-11-22 2019-08-09 $0.225 0.49% 2019-08-23 2019-05-10 $0.225 0.43% 2019-05-24 2019-02-08 $0.225 0.52% 2019-02-22 2018-11-09 $0.225 0.39% 2018-11-23 2018-11-08 $0.225 0.41% 2018-11-23 2018-08-10 $0.225 0.5% 2018-08-24 2018-05-11 $0.225 0.43% 2018-05-25 2018-02-09 $0.225 0.39% 2018-02-23 2017-11-06 $0.225 0.38% 2017-11-17 2017-08-03 $0.225 0.29% 2017-08-18 2017-05-04 $0.2 0.25% 2017-05-19 2017-02-02 $0.2 0.24% 2017-02-17 2016-11-03 $0.2 0.26% 2016-11-18 2016-08-04 $0.2 0.26% 2016-08-19 $0.175 0.29% 2016-05-20 2016-05-05 2016.02.04 STA 1775 38 2016.07 19 1.605 $1.125 $1.15 1.070 0.225 $0.9 $0.9 0.35 $0.85 $0.75 0.225 0.225 0.225 0.225 0.2 0.35 0.535 0.225 0.225 0.225 0.225 0.2 0.225 0.225 0.2 0.225 0.175 0.225 0.175 0.2 0.225 0.225 0.225 0.225 0.000 16 17 18 19 20 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts