Question: 1. Assuming that the expectations thebry is the correct one of the term structure, calculate the interest rates in the term structure for maturities. one

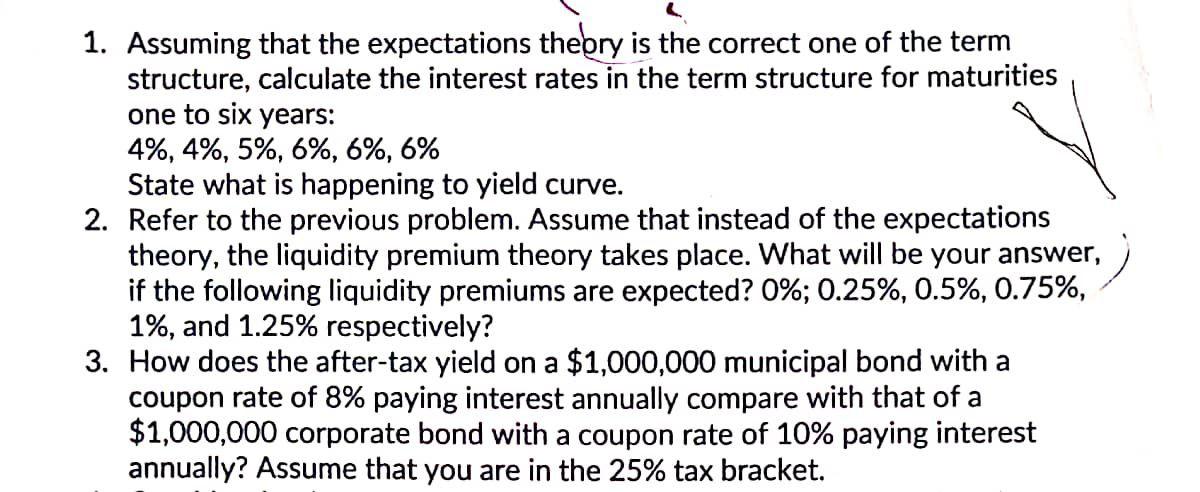

1. Assuming that the expectations thebry is the correct one of the term structure, calculate the interest rates in the term structure for maturities. one to six years: 4%,4%,5%,6%,6%,6% State what is happening to yield curve. 2. Refer to the previous problem. Assume that instead of the expectations theory, the liquidity premium theory takes place. What will be your answer, if the following liquidity premiums are expected? 0\%; 0.25%,0.5%,0.75%, 1% and 1.25% respectively? 3. How does the after-tax yield on a $1,000,000 municipal bond with a coupon rate of 8% paying interest annually compare with that of a $1,000,000 corporate bond with a coupon rate of 10% paying interest annually? Assume that you are in the 25% tax bracket

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts