Question: 1 b . ( 5 pts ) Under the 1 9 9 0 Farm Bill and given the initial situation of a target price and

b pts Under the Farm Bill and given the initial situation of a target price and marketing loan, indicate where the market price MP quantity supplied QS and demanded QD government stocks GS and Deficiency Payments DP and Marketing Loan Gains MLG if any, would be on the graph below. If applicable, indicate the price floor PF on the graph.

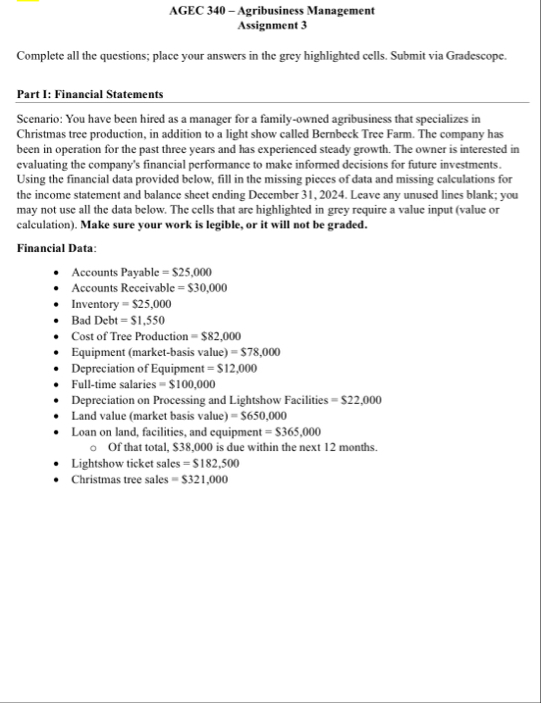

AGEC Agribusiness Management

Assignment

Complete all the questions; place your answers in the grey highlighted cells. Submit via Gradescope.

Part I: Financial Statements

Scenario: You have been hired as a manager for a familyowned agribusiness that specializes in Christmas tree production, in addition to a light show called Bernbeck Tree Farm. The company has been in operation for the past three years and has experienced steady growth. The owner is interested in evaluating the company's financial performance to make informed decisions for future investments. Using the financial data provided below, fill in the missing pieces of data and missing calculations for the income statement and balance sheet ending December Leave any unused lines blank; you may not use all the data below. The cells that are highlighted in grey require a value input value or calculation Make sure your work is legible, or it will not be graded.

Financial Data:

Accounts Payable $

Accounts Reccivable $

Inventory $

Bad Debt $

Cost of Tree Production $

Equipment marketbasis value$

Depreciation of Equipment $

Fulltime salaries $

Depreciation on Processing and Lightshow Facilities $

Land value market basis value$

Loan on land, facilities, and equipment $

Of that total, $ is due within the next months.

Lightshow ticket sales $

Christmas tree sales $

tableBalance Sheet for Bernbeck Tree Farm for the year ended December $$$AssetsCurrent AssetsCashchecking$Total Current Assets,,,,Fixed assetsProcessing and Lightshow Facilities,$Less: Accumulated Depreciation,,,,Total Fixed Assets,,,,OtherAssets$Total Assets,,,,LiabilitiesCurrent LiabilitiesAccrued Expenses,,$Total Current Liabilities,,,,LongTerm LiabilitiesOther$Total LongTerm Liabilities,,,,Total Liabilities,,,,Owners EquityOwners Equity,,,,Total Owner's Equity,,,,Total Liabilities and Owner's Equity,,,,

tableIncome Statement for Bernbeck Tree Farm for the year ended December Sales:Gross Sales,Less Returns, Allowances, and Discounts,Net Sales,Cost of Goods Sold:Revenue expense for Lightshow,Total Cost of Goods Sold,Gross Profit MarginOperating Expenses:Parttime salaries,Office suppliesexpensesPromotion and marketing,InsuranceUtility expenses electricity waterMiscellaneous expenses,Total Operating Expenses,Net Operating Income,Other Revenue,Interest Expense,Net Income Before Taxes,TaxesNet Income After Taxes,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock