Question: Old MathJax webview Old MathJax webview That is all the information given That is the question. For items 1 and 2, please refer to the

Old MathJax webview

That is all the information given

That is the question.

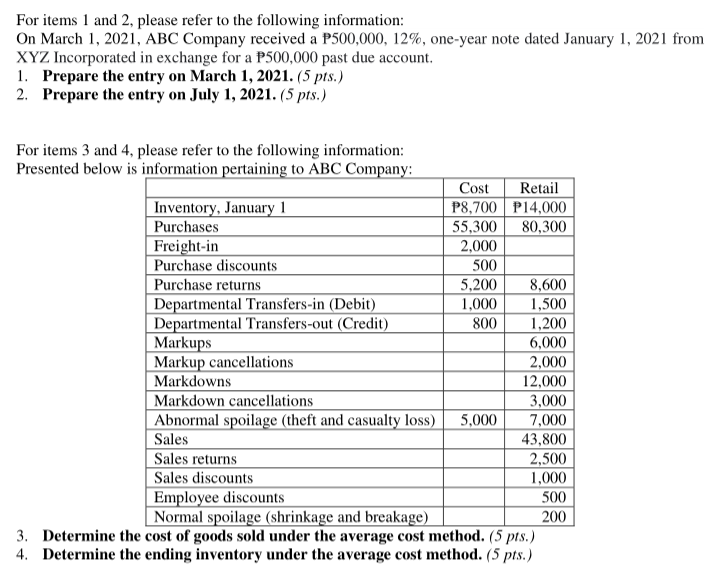

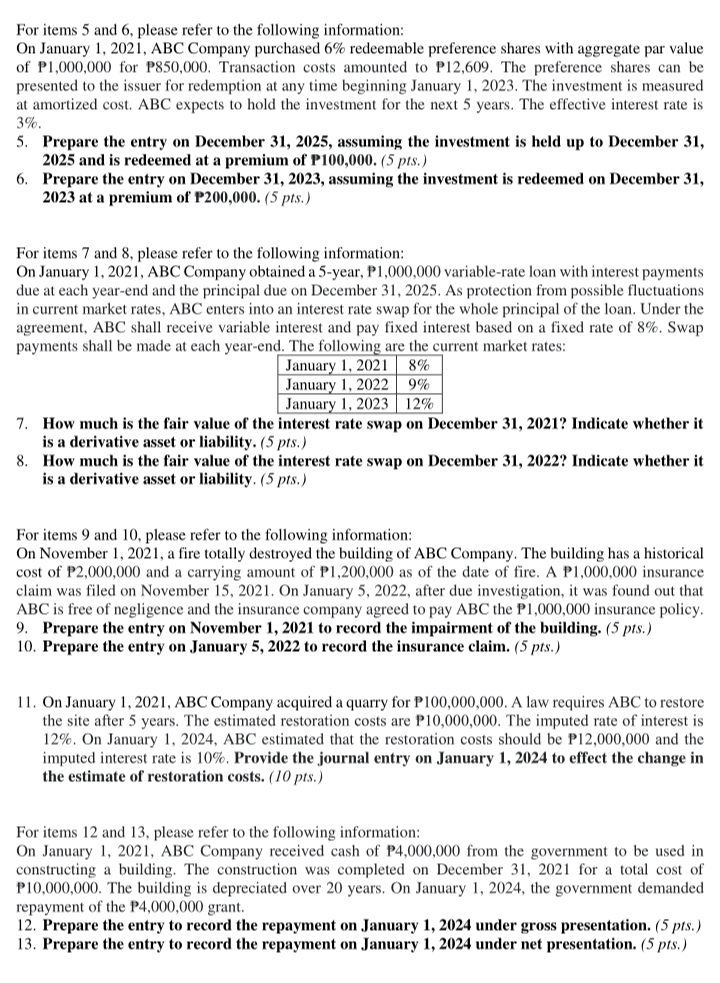

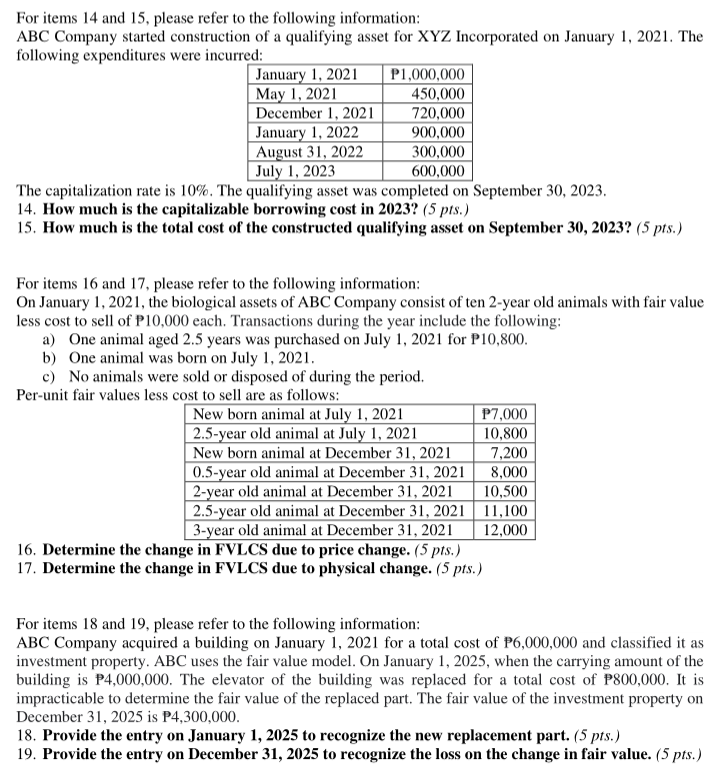

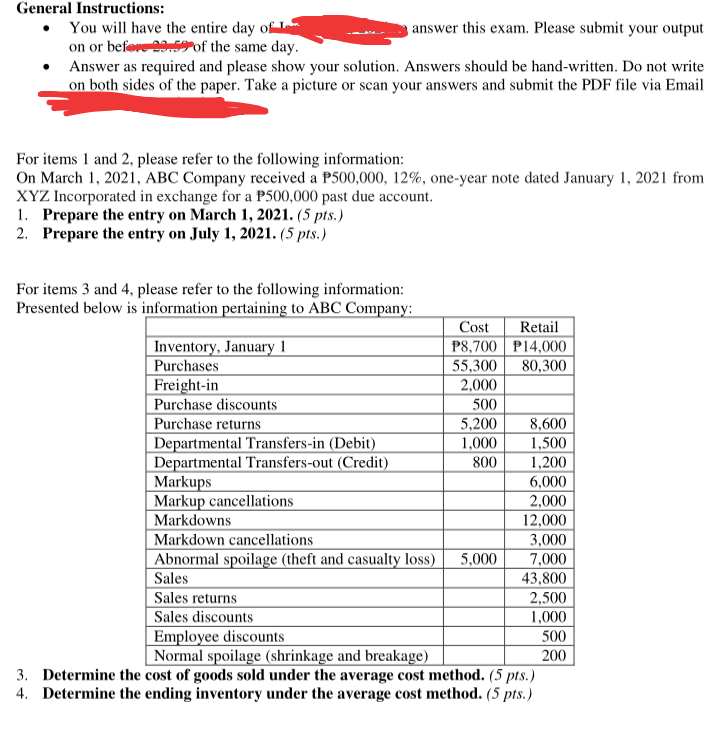

For items 1 and 2, please refer to the following information: On March 1, 2021, ABC Company received a P500,000, 12%, one-year note dated January 1, 2021 from XYZ Incorporated in exchange for a P500,000 past due account. 1. Prepare the entry on March 1, 2021. (5 pts.) 2. Prepare the entry on July 1, 2021. (5 pts.) For items 3 and 4, please refer to the following information: Presented below is information pertaining to ABC Company: Cost Retail Inventory, January 1 P8,700 P14,000 Purchases 55,300 80,300 Freight-in 2,000 Purchase discounts 500 Purchase returns 5,200 8,600 Departmental Transfers-in (Debit) 1,000 1,500 Departmental Transfers-out (Credit) 800 1,200 Markups 6,000 Markup cancellations 2,000 Markdowns 12,000 Markdown cancellations 3,000 Abnormal spoilage (theft and casualty loss) 5,000 7,000 Sales 43,800 Sales returns 2,500 Sales discounts 1,000 Employee discounts 500 Normal spoilage (shrinkage and breakage) 200 3. Determine the cost of goods sold under the average cost method. (5 pts.) 4. Determine the ending inventory under the average cost method. (5 pts.) For items 5 and 6, please refer to the following information: On January 1, 2021, ABC Company purchased 6% redeemable preference shares with aggregate par value of P1,000,000 for P850,000. Transaction costs amounted to P12,609. The preference shares can be presented to the issuer for redemption at any time beginning January 1, 2023. The investment is measured at amortized cost. ABC expects to hold the investment for the next 5 years. The effective interest rate is 3%. 5. Prepare the entry on December 31, 2025, assuming the investment is held up to December 31, 2025 and is redeemed at a premium of P100,000. (5 pts.) 6. Prepare the entry on December 31, 2023, assuming the investment is redeemed on December 31, 2023 at a premium of P200,000. (5 pts.) For items 7 and 8, please refer to the following information: On January 1, 2021, ABC Company obtained a 5-year, P1,000,000 variable-rate loan with interest payments due at each year-end and the principal due on December 31, 2025. As protection from possible fluctuations in current market rates, ABC enters into an interest rate swap for the whole principal of the loan. Under the agreement, ABC shall receive variable interest and pay fixed interest based on a fixed rate of 8%. Swap payments shall be made at each year-end. The following are the current market rates: January 1, 2021 8% January 1, 2022 9% January 1, 2023 12% 7. How much is the fair value of the interest rate swap on December 31, 2021? Indicate whether it is a derivative asset or liability. (5 pts.) 8. How much is the fair value of the interest rate swap on December 31, 2022? Indicate whether it is a derivative asset or liability. (5 pts.) For items 9 and 10, please refer to the following information: On November 1, 2021, a fire totally destroyed the building of ABC Company. The building has a historical cost of P2,000,000 and a carrying amount of P1,200,000 as of the date of fire. A P1,000,000 insurance claim was filed on November 15, 2021. On January 5, 2022, after due investigation, it was found out that ABC is free of negligence and the insurance company agreed to pay ABC the P1,000,000 insurance policy. 9. Prepare the entry on November 1, 2021 to record the impairment of the building. (5 pts.) 10. Prepare the entry on January 5, 2022 to record the insurance claim. (5 pts.) 11. On January 1, 2021, ABC Company acquired a quarry for P100,000,000. A law requires ABC to restore the site after 5 years. The estimated restoration costs are P10,000,000. The imputed rate of interest is 12%. On January 1, 2024, ABC estimated that the restoration costs should be P12,000,000 and the imputed interest rate is 10%. Provide the journal entry on January 1, 2024 to effect the change in the estimate of restoration costs. (10 pts.) For items 12 and 13, please refer to the following information: On January 1, 2021, ABC Company received cash of P4,000,000 from the government to be used in constructing a building. The construction was completed on December 31, 2021 for a total cost of P10,000,000. The building is depreciated over 20 years. On January 1, 2024, the government demanded repayment of the P4,000,000 grant. 12. Prepare the entry to record the repayment on January 1, 2024 under gross presentation. (5 pts.) 13. Prepare the entry to record the repayment on January 1, 2024 under net presentation. (5 pts.) For items 14 and 15, please refer to the following information: ABC Company started construction of a qualifying asset for XYZ Incorporated on January 1, 2021. The following expenditures were incurred: January 1, 2021 P1,000,000 May 1, 2021 450,000 December 1, 2021 720,000 January 1, 2022 900,000 August 31, 2022 300,000 July 1, 2023 600,000 The capitalization rate is 10%. The qualifying asset was completed on September 30, 2023. 14. How much is the capitalizable borrowing cost in 2023? (5 pts.) 15. How much is the total cost of the constructed qualifying asset on September 30, 2023? (5 pts.) For items 16 and 17, please refer to the following information: On January 1, 2021, the biological assets of ABC Company consist of ten 2-year old animals with fair value less cost to sell of P10,000 each. Transactions during the year include the following: a) One animal aged 2.5 years was purchased on July 1, 2021 for P10,800. b) One animal was born on July 1, 2021. c) No animals were sold or disposed of during the period. Per-unit fair values less cost to sell are as follows: New born animal at July 1, 2021 27,000 2.5-year old animal at July 1, 2021 10,800 New born animal at December 31, 2021 7,200 0.5-year old animal at December 31, 2021 8,000 2-year old animal at December 31, 2021 10,500 2.5-year old animal at December 31, 2021 11,100 3-year old animal at December 31, 2021 12,000 16. Determine the change in FVLCS due to price change. (5 pts.) 17. Determine the change in FVLCS due to physical change. (5 pts.) For items 18 and 19, please refer to the following information: ABC Company acquired a building on January 1, 2021 for a total cost of P6,000,000 and classified it as investment property. ABC uses the fair value model. On January 1, 2025, when the carrying amount of the building is P4,000,000. The elevator of the building was replaced for a total cost of P800,000. It is impracticable to determine the fair value of the replaced part. The fair value of the investment property on December 31, 2025 is P4,300,000. 18. Provide the entry on January 1, 2025 to recognize the new replacement part. (5 pts.) 19. Provide the entry on December 31, 2025 to recognize the loss on the change in fair value. (5 pts.) General Instructions: You will have the entire day of la answer this exam. Please submit your output on or before of the same day, Answer as required and please show your solution. Answers should be hand-written. Do not write on both sides of the paper. Take a picture or scan your answers and submit the PDF file via Email For items 1 and 2, please refer to the following information: On March 1, 2021, ABC Company received a P500,000, 12%, one-year note dated January 1, 2021 from XYZ Incorporated in exchange for a P500,000 past due account. 1. Prepare the entry on March 1, 2021. (5 pts.) 2. Prepare the entry on July 1, 2021. (5 pts.) For items 3 and 4, please refer to the following information: Presented below is information pertaining to ABC Company: Cost Retail Inventory, January 1 P8,700 P14,000 Purchases 55,300 80,300 Freight-in 2,000 Purchase discounts 500 Purchase returns 5,200 8,600 Departmental Transfers-in (Debit) 1,000 1,500 Departmental Transfers-out (Credit) 800 1,200 Markups 6,000 Markup cancellations 2,000 Markdowns 12,000 Markdown cancellations 3,000 Abnormal spoilage (theft and casualty loss) 5,000 7,000 Sales 43,800 Sales returns 2,500 Sales discounts 1,000 Employee discounts 500 Normal spoilage (shrinkage and breakage) 200 3. Determine the cost of goods sold under the average cost method. (5 pts.) 4. Determine the ending inventory under the average cost method. (5 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts