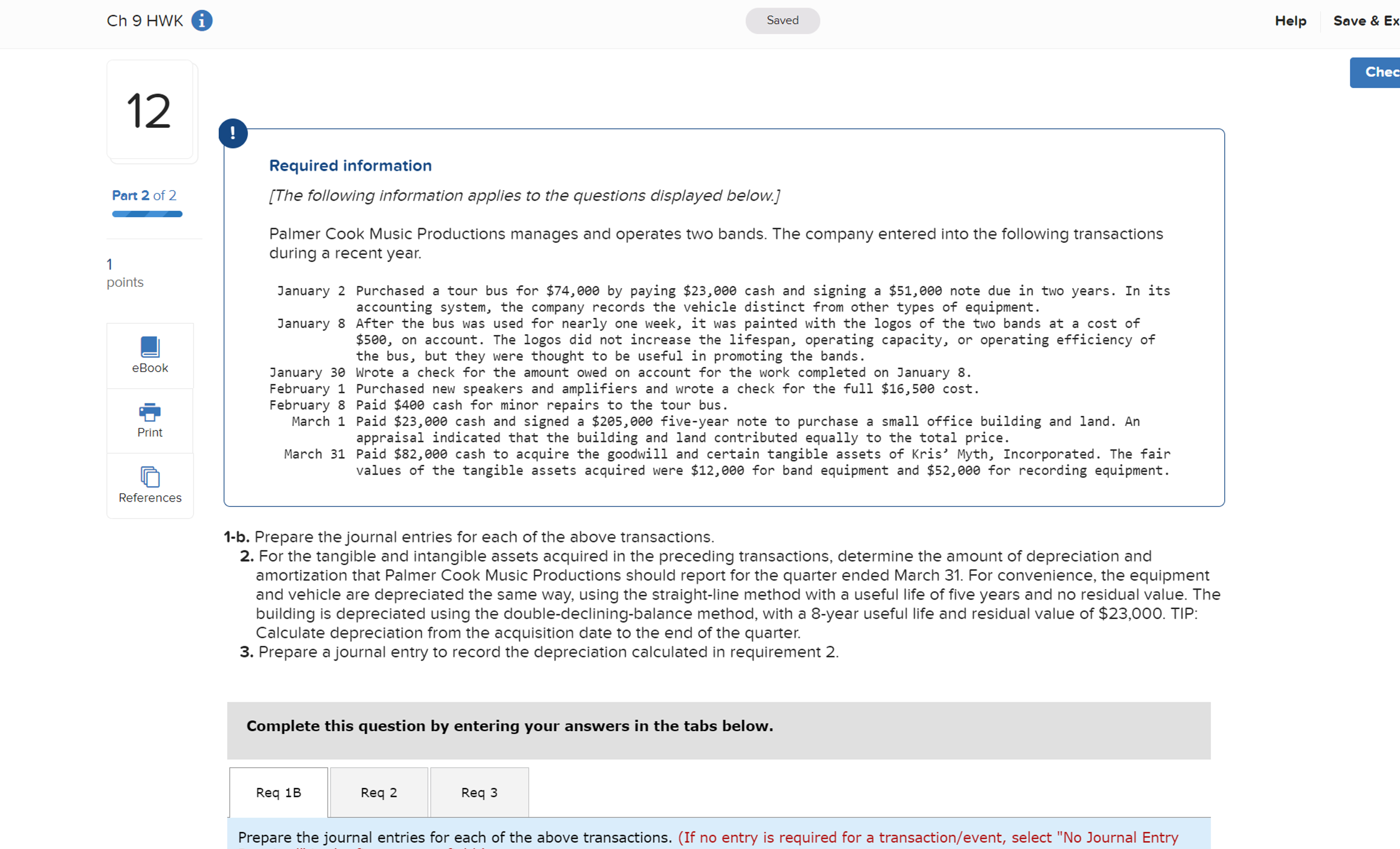

Question: 1 - b . Prepare the journal entries for each of the above transactions. For the tangible and intangible assets acquired in the preceding transactions,

b Prepare the journal entries for each of the above transactions.

For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and

amortization that Palmer Cook Music Productions should report for the quarter ended March For convenience, the equipment

and vehicle are depreciated the same way, using the straightline method with a useful life of five years and no residual value. The

building is depreciated using the doubledecliningbalance method, with a year useful life and residual value of $ TIP:

Calculate depreciation from the acquisition date to the end of the quarter.

Prepare a journal entry to record the depreciation calculated in requirement

Complete this question by entering your answers in the tabs below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock