Question: . 1. b13 2. 3. Opening Entry: The entry is made for carrying forward the balances of assets and liabilities from the balance sheet of

.

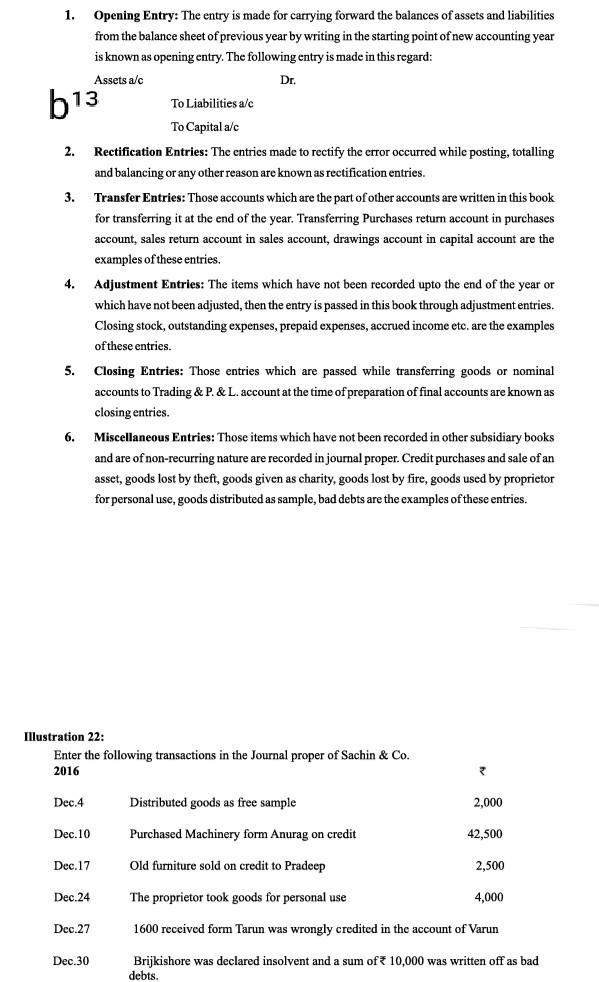

1. b13 2. 3. Opening Entry: The entry is made for carrying forward the balances of assets and liabilities from the balance sheet of previous year by writing in the starting point of new accounting year is known as opening entry. The following entry is made in this regard: Assets a/c Dr. 3 To Liabilities a/c To Capital a/c Rectification Entries: The entries made to rectify the error occurred while posting, totalling and balancing or any other reason are known as rectification entries. Transfer Entries: Those accounts which are the part of other accounts are written in this book for transferring it at the end of the year. Transferring Purchases return account in purchases account, sales return account in sales account, drawings account in capital account are the examples of these entries. Adjustment Entries: The items which have not been recorded upto the end of the year or which have not been adjusted, then the entry is passed in this book through adjustment entries. Closing stock, outstanding expenses, prepaid expenses, accrued income etc. are the examples of these entries. Closing Entries: Those entries which are passed while transferring goods or nominal accounts to Trading & P. & L. account at the time of preparation of final accounts are known as closing entries. Miscellaneous Entries: Those items which have not been recorded in other subsidiary books and are of non-recurring nature are recorded in journal proper. Credit purchases and sale of an asset, goods lost by theft, goods given as charity, goods lost by fire, goods used by proprietor for personal use, goods distributed as sample, bad debts are the examples of these entries. 4. 5. 6. Illustration 22: Enter the following transactions in the Journal proper of Sachin & Co. 2016 Dec.4 Distributed goods as free sample 2,000 Dec. 10 Purchased Machinery form Anurag on credit 42,500 Dec. 17 Old furniture sold on credit to Pradeep 2,500 Dec.24 The proprietor took goods for personal use 4,000 Dec.27 1600 received form Tarun was wrongly credited in the account of Varun Dec. 30 Brijkishore was declared insolvent and a sum of 10,000 was written off as bad debtsStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock