Question: 1. Based on the long-term increase in value, which project is the best choice? 2. Why is this project the best choice? 3. How does

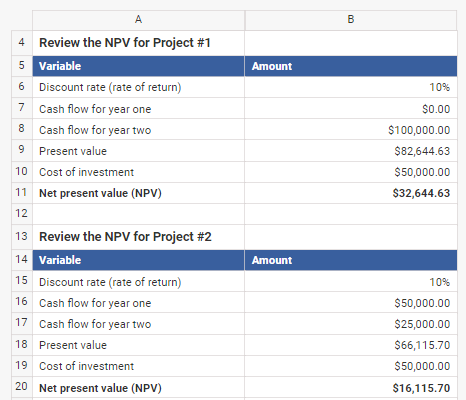

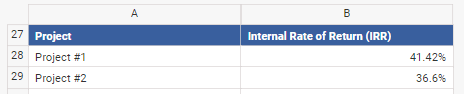

1. Based on the long-term increase in value, which project is the best choice?

2. Why is this project the best choice?

3. How does your decision connect to the first financial principle, money has a time value?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts