Question: 1. Based on the long-term increase in value, which project is the best choice? 2. Why is this project the best choice? 3. How does

1. Based on the long-term increase in value, which project is the best choice?

2. Why is this project the best choice?

3. How does your decision connect to the first financial principle, money has a time value?

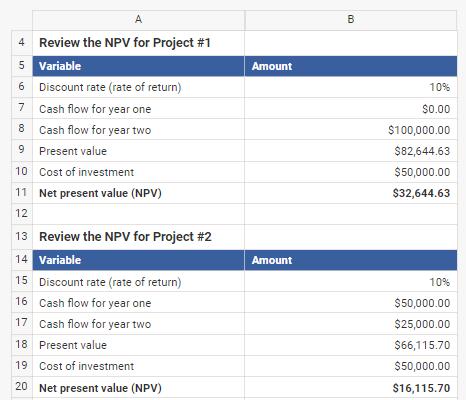

A 4 Review the NPV for Project #1 5 Variable 6 7 Cash flow for year one 8 Cash flow for year two Present value 9 10 Cost of investment 11 Net present value (NPV) 12 13 Review the NPV for Project #2 14 Variable 15 Discount rate (rate of return) 16 Cash flow for year one 17 Cash flow for year two 18 Present value 19 Cost of investment 20 Net present value (NPV) Discount rate (rate of return) Amount Amount B 10% $0.00 $100,000.00 $82,644.63 $50,000.00 $32,644.63 10% $50,000.00 $25,000.00 $66,115.70 $50,000.00 $16,115.70

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Based on the longterm increase in value project 1 is the best choice Here is the working Project ... View full answer

Get step-by-step solutions from verified subject matter experts