Question: QUESTION 2.21 (Comprehensive, inter vivos trust) During the 2021/22 tax year, Porter Chrystan created the Blind Trust, an inter vivos trust to provide services

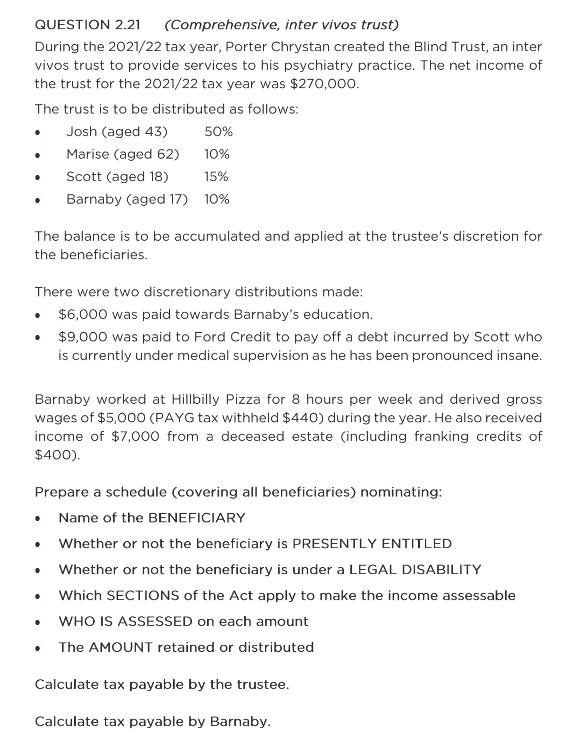

QUESTION 2.21 (Comprehensive, inter vivos trust) During the 2021/22 tax year, Porter Chrystan created the Blind Trust, an inter vivos trust to provide services to his psychiatry practice. The net income of the trust for the 2021/22 tax year was $270,000. The trust is to be distributed as follows: Josh (aged 43) 50% Marise (aged 62) 10% . Scott (aged 18) 15% Barnaby (aged 17) 10% The balance is to be accumulated and applied at the trustee's discretion for the beneficiaries. There were two discretionary distributions made: . $6,000 was paid towards Barnaby's education. $9,000 was paid to Ford Credit to pay off a debt incurred by Scott who is currently under medical supervision as he has been pronounced insane. Barnaby worked at Hillbilly Pizza for 8 hours per week and derived gross wages of $5,000 (PAYG tax withheld $440) during the year. He also received income of $7,000 from a deceased estate (including franking credits of $400). Prepare a schedule (covering all beneficiaries) nominating: Name of the BENEFICIARY . Whether or not the beneficiary is PRESENTLY ENTITLED Whether or not the beneficiary is under a LEGAL DISABILITY Which SECTIONS of the Act apply to make the income assessable WHO IS ASSESSED on each amount . The AMOUNT retained or distributed Calculate tax payable by the trustee. Calculate tax payable by Barnaby.

Step by Step Solution

There are 3 Steps involved in it

The Blind Trust created by Porter Chrystan has a net income of 270000 for the 202122 tax year which is to be distributed among the beneficiaries as follows Josh aged 43 50 Marise aged 62 10 Scott aged ... View full answer

Get step-by-step solutions from verified subject matter experts